FTSE 100 gives up 0.19% at 7,221 as it continues the correction from monthly highs as no-deal Brexit worries eased while UK Average Earnings Including Bonus (3Mo/Yr) came in at 4% topping forecasts of 3.7% in July, the Average Earnings Excluding Bonus (3Mo/Yr) matched expectations of 3.8% in July. The ILO Unemployment Rate (3M) came in at 3.8% below forecasts of 3.9% in July.

PM Johnson second call for a snap general election was rejected by MPs yesterday, meaning an election scenario before the deadline of October 31st has cancelled.

FTSE 100 getting a boost from JD Sports +5.98%, IAG +3.75%, Barclays plc +3.67% and RBS +3.06%. On the other hand, Just Eat is -4.53%, Experian is –3.69% and LSE is -3.42% lower.

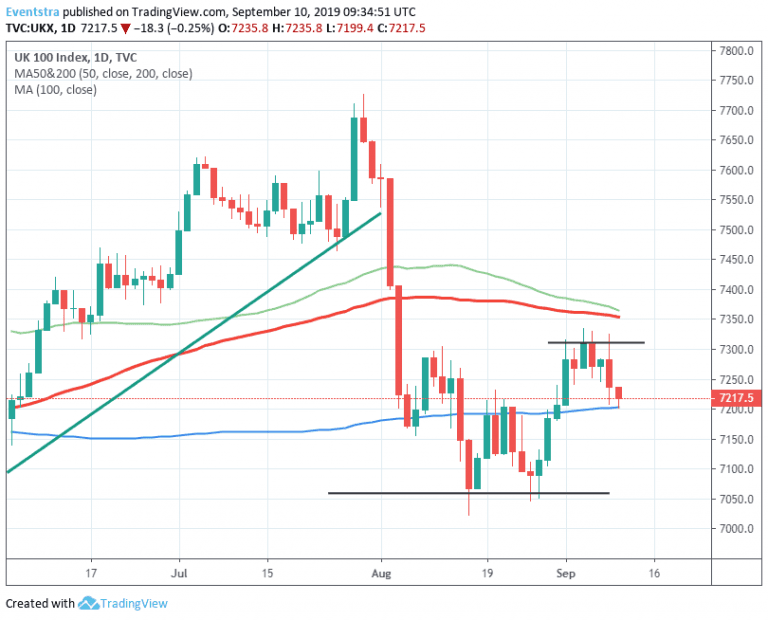

On the technical side FTSE 100 tested successfully today the 50-day moving average at 7,200 and managed to rebound as it digests the impressive rebound from four-month lows. The index facing the resistance at 7,235 daily high and then at 7,310 weekly high, while more offers will be met at 7,353 the 100-day moving average which is critical for the FTSE’s moves in the upcoming trading sessions; a close above could open the way for 7,366 and the 200 day moving average. On the downside immediate support stands at 7,199 today’s low, while a break below will open the way for a test of 7,106 low from August 29th.

European indices also trading lower, the DAX 30 gives up 0.10% to 12,212 while the CAC 40 in Paris trading 0.37% lower at 5,568, In Milan the FTSE MIB is giving up 0.25% at 21,935.

In Wall Street, the Dow Jones futures trading 0.19% lower at 26,788, the S&P 500 futures are 0.22% lower at 2,972 while the Nasdaq futures are 0.31% lower at 7,806 signaling a weak start for equities in the other side of the Atlantic.Don’t miss a beat! Follow us on Telegram and Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.

Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.