FTSE 100 started the session higher mirroring the strong performance in Wall Street. FTSE snaps three straight days of loses that drove the index to three-month lows as the rally in British pound weigh on FTSE exporting companies.

On the economic data, the U.K. Nationwide Housing Prices seasonally adjusted came in at 2% in August topping the forecasts of 0.5%, the yearly reading for Nationwide Housing Prices non-seasonally adjusted registered in at 3.7% above the estimates of 2%. Yesterday, the U.K. Manufacturing PMI reported in at 55.2 in August the highest reading since February but failed to beat the expectations of 55.3. The previous month reading was at 53.3.

The positive momentum in stocks mostly supported by the rally in the big technology stocks such as Apple, Amazon, Tesla e.t.c. and better than expected manufacturing data from the USA. The U.S. ISM Manufacturing PMI came in at 56, beating the forecasts of 54.5 in August. The ISM Manufacturing Employment Index registered in at 46.4 topping the estimates of 45.8 in August while the ISM New Orders Index jumped to 67.6 well above the forecasts of 53.5.

The main dish of the economic calendar will be the U.S. ADP report. Analysts expect the ADP to show 950,000 new jobs created in August well above the 167,000 created in July.

Barratt Developments is the top gainer adding 6.20% at 535.10 after the company announced that the total forward sales at August 23 were at 15,660 homes well above the 13,064 sales a year ago.

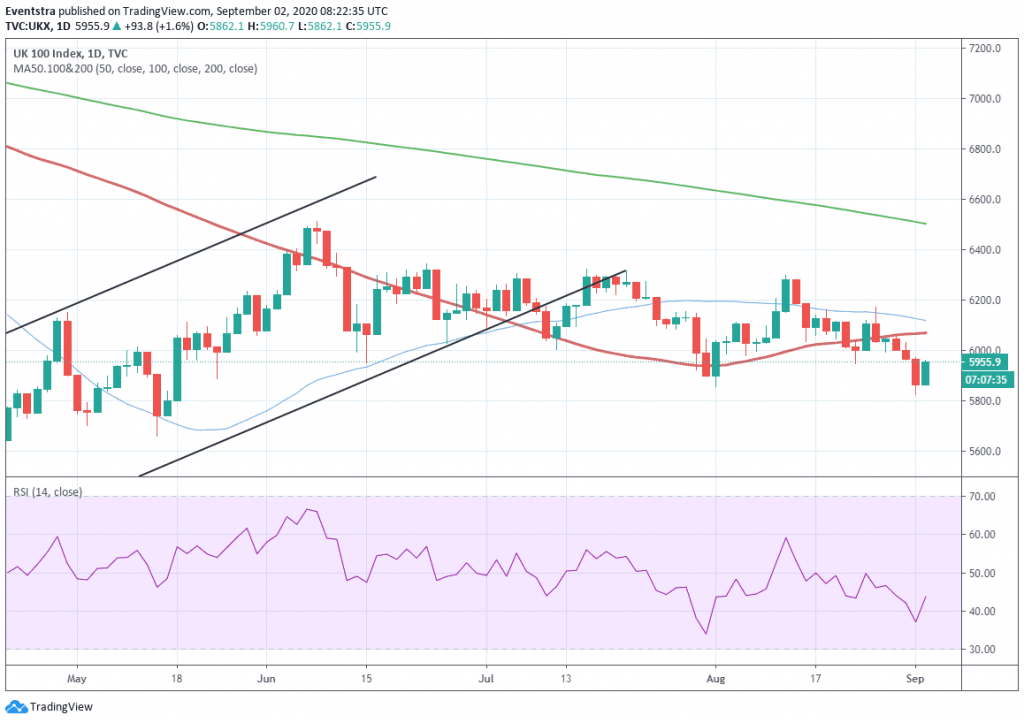

FTSE 100 Analysis

FTSE 100 is 1.34% higher at 5,940 as the index attempts a rebound from the three-month lows. The technical picture remains bearish despite today’s strong gains. The FTSE 100 index breached below the 100-day moving average the previous week, and now sellers are in control.

What can cancel the bearish momentum is a return of the index above the 100-day moving average at 6,069. The next resistance area for the FTSE index would be met at 6,119 the 50-day moving average.

On the contrary, support for the index is at 5,862 the daily low. More bids would emerge at 5,818 the low from yesterday’s trading session. The next support is at 5,665 the low from May 14. You can check One to One Trading Coaching to learn more about entries, stop-loss, and take profit strategies

Don’t miss a beat! Follow us on Telegram and Twitter.

FTSE 100 Daily Chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Nikolas on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.