Despite the drop in the Pound this Friday, the FTSE 100 index has endured a second day of steep selloffs, taking its losing streak to three sessions. This puts the index on course to end the week lower after investors got spooked by the state of the global economy, rising energy prices and spiralling inflation.

In data released by the US Bureau of Labor Statistics, the headline consumer price index for May 2022 came in at 1.0%, a 0.7% increase from the previous month and more than the market consensus of 0.7%. The core figure, excluding food and energy prices, came in at 0.6% versus the market expectation of 0.5%. The figure remains unchanged from last month’s 0.6% rise. The data show that on an annualized basis, inflation is up 8.6% versus the market prediction of 8.3%. This puts US inflation at 41-year highs.

Inflationary pressure in the United Kingdom is biting hard and impacting consumers and the retail industry. Commerzbank has said that the data shows that the Fed is lagging behind the inflation curve and would need to raise rates aggressively to stem inflation.

The Bank of England (BoE) is due to meet next week to decide on the interest rates going forward. Taking a cue from what’s happening with the US inflation picture, the BoE may step on the accelerator harder than the markets expect, which is a potentially bearish trigger for the FTSE 100.

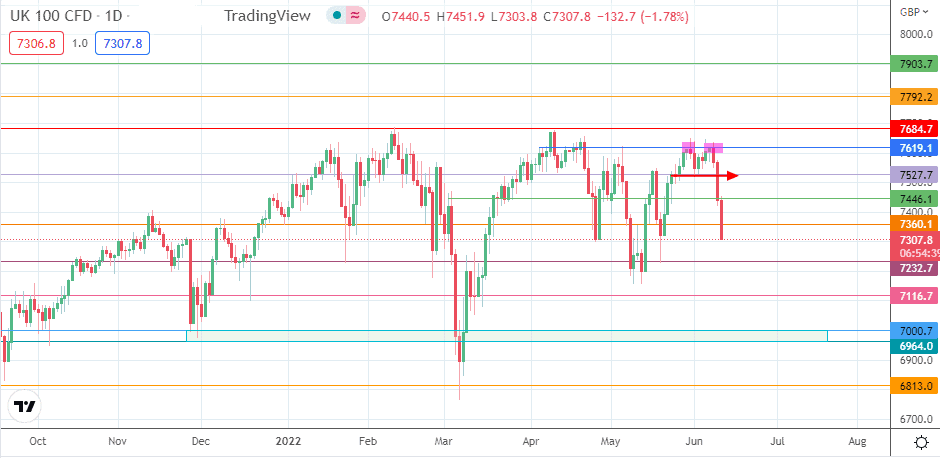

A look at the daily chart of the FTSE 100 index shows that the three-day decline was triggered by the break of the double top’s neckline at 7527.7. The following cascade has produced a combined 3.6% drop in the market’s value over the last two trading sessions. Here is the outlook for the FTSE 100 index heading into next week.

FTSE 100 Index Outlook

The day’s steep slide has broken below the 7360.1 support level (31 December 2021 and 22 February 2022 lows). This drop has opened the door for a decline that targets the 24 January 2022/19 May 2022 lows at 7232.7. Attainment of the 7116.7 support depends on the bears’ ability to degrade the lows of 10 May and 12 May at 7156.3. Below this level, a support zone found between 6964.0 and 7000.7 forms an additional southbound target.

On the flip side, the uptrend recovery will only happen if the bulls uncap 7619.1 (6 April and 5 May highs). This would open the door toward the 7684.7 resistance (10 February 2022 high) and 7792.2 after that. The road to the limiting barrier at 7619.1 is long, requiring a bounce that takes out 7360.1 (acting as a role-reversed resistance), 7446.1 and 7527.7, in that order.

FTSE 100: Daily Chart