The FTSE 100 index is hovering at the lowest level in over a month as concerns about its constituents wane. Most of its constituents are struggling as the cost of doing business has risen. The index is trading at £7,384, about 3.78% below the highest level this month. Other global indices like the DAX, CAC 40, Hang Seng, and Nikkei 225 are also struggling.

The FTSE 100 index is under pressure because of the overall performance of its constituent companies. For example, the HSBC share price crashed by over 5% on Tuesday after the company warned about the slowdown in Asia and the impacts of the ongoing crisis in Ukraine. Similarly, the Ocado share price dropped by over 8.30% as investors worried about the company’s growth now that e-commerce sales have started falling.

Meanwhile, the Associated British Food share price dropped by 5% after the company warned about its margins. Other top constituents that have fallen sharply this week include IAG, Rolls-Royce, Schroders, Aveva, and Standard Chartered. The index has also fallen as UK dividends crashed in the first quarter.

The next key FTSE 100 components to watch will be banks like NatWest, Lloyds Bank, Barclays, and Standard Chartered, expected to publish quarterly results. Most analysts expect most of these banks to publish weak results even after the Bank of England made two rate hikes in the first quarter. This week, other companies set to publish are London Stock Exchange, Persimmon, Aveva Group, Fresnillo, Glencore, and Unilever.

FTSE 100 forecast

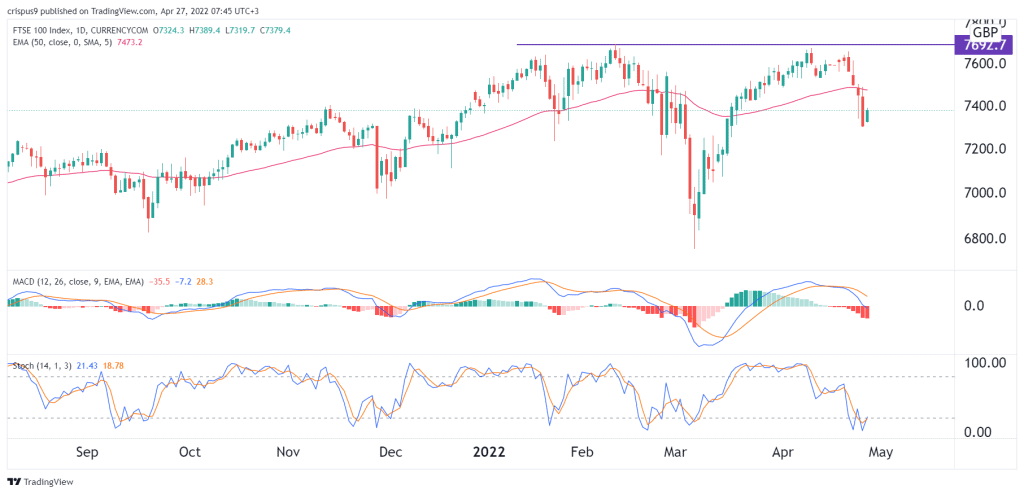

The daily chart shows that the FTSE 100 index has been in a downward trend in the past few days. It fell in the past ten days and moved below the 25-day moving average. The MACD and the Stochastic oscillator have also continued dropping. It also formed a small double-top pattern.

Therefore, there is a likelihood that the Footsie will continue underperforming in the coming days. If this happens, the next key level to watch will be at 7,000. A move above the resistance at 7,500 will invalidate this view.