The USD/ZAR will come under the radar this evening when the FOMC announces its interest rate decision. The South African Rand is an emerging market currency which typically reacts to this fundamental trigger, as the direction of US interest rates works in tandem with the direction of investment flows from emerging market economies.

The Rand is expected to weaken further if the Fed delivers an aggressive 100bps rate hike. The markets have largely priced in an expectation of a 75bps rate hike, and this could lead to a muted response on the pair in the period immediately following the news. However, the greenback is expected to resume its gradual strengthening over a Rand whose economy has been battered by a host of economic shocks.

The USDZAR is currently trading lower by 0.42%, as the Rand has recovered some of Tuesday’s losses. This decline is presently challenging a support level, and the outcome of the FOMC decision will determine if the pair will resume the recovery move or not, using this pivot as a reference point.

USD/ZAR Forecast

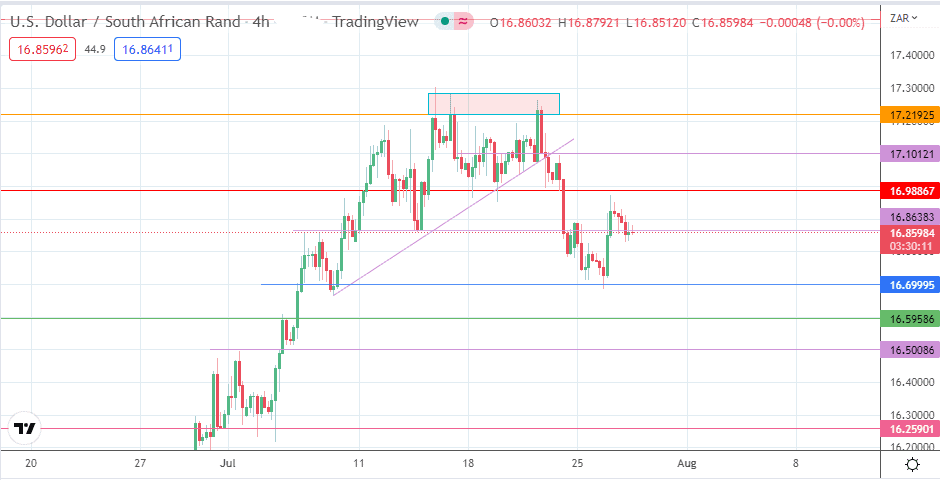

The breakdown of the ascending trendline at the 17.1000 price mark has led to a cascading drop of the pair toward the 6 July high/26 July low at 16.69995. The bounce from his area fell just short of the 16.98867 resistance, resulting in a pullback that now challenges the support at 16.86383.

A breakdown of this support allows the bears to aim for a retest of the 16.69995 price mark. Below this level, 16.59586 (5 July high) and 16.50000 (5 July 2022 high) are additional targets to the south. This outlook would follow any rate hikes that are short of 75bps.

On the flip side, a bounce on the 16.86383 support allows for a recovery toward 16.98867. This resistance barrier has to give way for 17.10121 (19 July high) to enter the mix. 17.21925 is the floor of the demand zone that lies above the trendline, which also has 17.28589 as the ceiling. The outlook favours a situation where the Fed delivers on a 100bps rate hike. A 75bps rate hike has been largely priced in and could deliver a more muted response.

USD/ZAR: 4-hour Chart