Fed’s Charles Evan delivers a speech in Chicago here are the key points so far:

- Labor markets seem quite vibrant, drawing in more people. Fed still debating what full employment means in current economy.

- U.S. economy has very solid fundamentals and Consumer still ‘very strong’; the business investment is weaker than expected.

- Expects growth at around 2% for 2019, close to what he regards as sustainable trend.

- Nervous about underrunning inflation objective

- Policy is ‘about neutral’ but could be more accommodative if the aim was to lift inflation. Part of policy should be to aim to get inflation above 2% for a while to ‘ratify’ Fed credibility.

- A couple of rate cuts could lift inflation by 2021.

- Hard for businesses to make long-term plans given uncertainty around trade landscape.

- The slowing foreign growth is going to dampen the US economy.

- Risk management approach means being a little more accommodative in case downside risks materialize, but we don’t want to go too far

- Agreed with December rate hike despite the uncertainty

- Could argue for rate cuts on inflation, global slowdown

- Low inflation, expectations show policy too restrictive

- Discussing rate cuts is important, timing isn’t critical

- Sees 50 basis point reduction appropriate by year end”

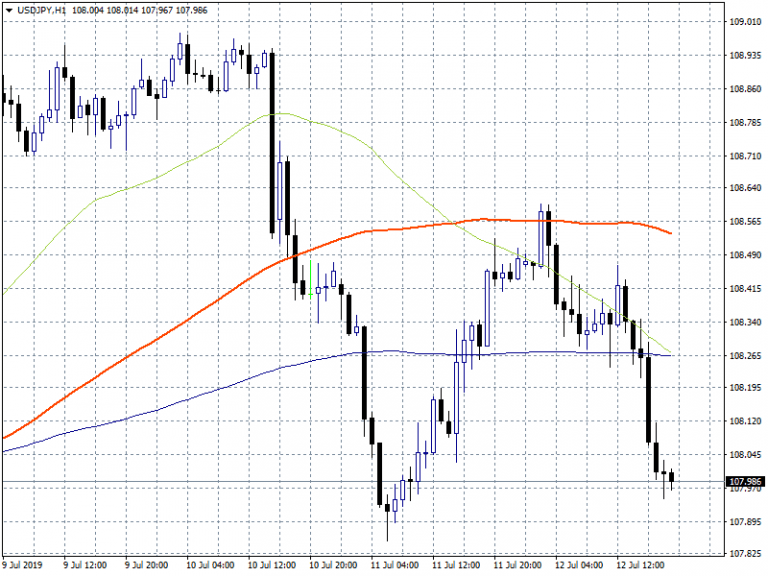

EURUSD reacted slightly positive to Evans comments and added about 10 pips to 1.1255. GBPUSD attracted some bids during the speech and hit the daily high at 1.2562 or it might be random buying as the London traders exit for the week. USDJPY affected the most as it lost almost 25 pips and broke below the 108 level.Don’t miss a beat! Follow us on Twitter.

Download our Q3 market outlook today for our longer-term outlook for the markets and trade ideas.

Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.