The Facebook share price has fallen 3% on the day as the stock retreats from the $300 level for a second time. The move lower mirrors a 3.46% drop in the Nasdaq 100 as high jobless claims and a slowdown in the services sector had traders nervous about a slower economic recovery.

Jobless claims were lower on the week but at 880k, they are still high, whilst yesterday’s big miss on ADP Employment numbers will have investors shying away from bullish predictions on tomorrow’s Non Farm Payrolls release.

Facebook also announced that a series of policy changes ahead of the upcoming U.S. election. The platform will not allow any new political ads in the week before the election. The company also raised the risk that the election may take longer to be finalized due to higher mail-in voting. CEO Mark Zuckerberg said of the change:

“with our nation so divided and election results potentially taking days or even weeks to be finalized, there could be an increased risk of civil unrest across the country.”

Facebook faced a backlash from advertisers in the summer over claims that the social media giant was not policing content enough. This led to an ad boycott from various big name corporations and the effects of the boycott have yet to be seen in the company’s earnings, which will be released after the current quarter.

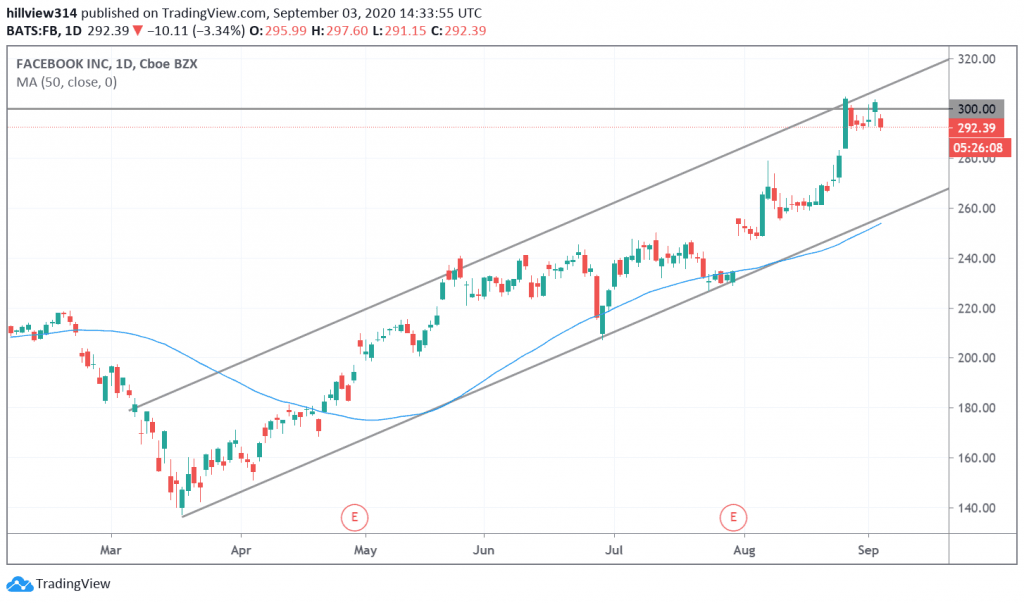

Facebook Technical Outlook

Facebook shares have pulled back from the $300 level to $292.39. The move coincides with a rising price channel resistance line and there is a possibility of a deeper correction. The recent rally leaves little support to the $260 level and this would be the first target. If the channel failed to hold then this could see the $220-200 levels come into play. The $300 level would be the obvious area for a stop loss. The channel support also meets the 50 moving average so bullish traders should look for a buy on support there. The Investing Cube Trading Program can help new traders build market skills. Find more details here.

Don’t miss a beat! Follow us on Telegram and Twitter.

Facebook Daily Chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Kevin on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.