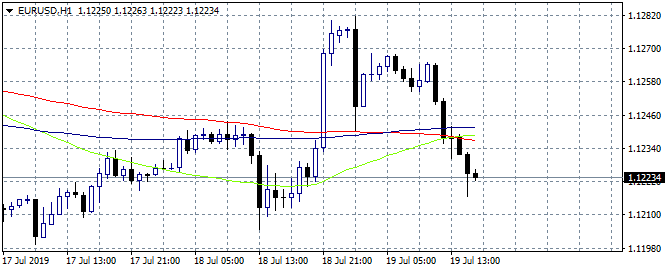

EURUSD trading at 1.1224 having hit the high during Asian session at 1.1281 where rejected for second day opening the way for testing the low from yesterday and as we are heading for the weekly closing bell might test the 1.1191 hurdle of the recent trading range.

The pair broke below the support at 1.1248 the 100 day moving average and bears now are in control. As I wrote earlier “A break below the 1.1248 mark will attract offers targeting 1.12 zone”, that is the case for now amid general USD strength and rising rumors of a government crisis in Italy that might lead to snap elections; the FTSE Mib in Milan is underperforming the other European indices giving up over 1.5%. Traders have to avoid now long positions as the political drama in Italy resurfaces. Earlier today Angela Merkel said that the German economy is in a difficult phase with slower growth, and the weaker economic conditions give us reason to try and stimulate the domestic economy. The Economic slowdown is largely due to uncertainty in global trade and she hopes that China and USA can make progress in trade talks.

A short position targeting the 1.12 mark with a stop loss order at 1.1230 is something that day traders can try. A long position might be initiated if the pair manages to climb above 1.1236 targeting the daily high. A narrow stop loss to 1.1216 must also be placed for reducing the downside risk.

EURUSD is very sensitive to comments from Fed policy members, later today we have two speeches from Federal Reserve Bank of St. Louis President James Bullard at 15:05GMT and Federal Reserve Bank of Boston President Eric Rosengren, so we have to be very careful and adjust our positions accordingly.Don’t miss a beat! Follow us on Twitter.