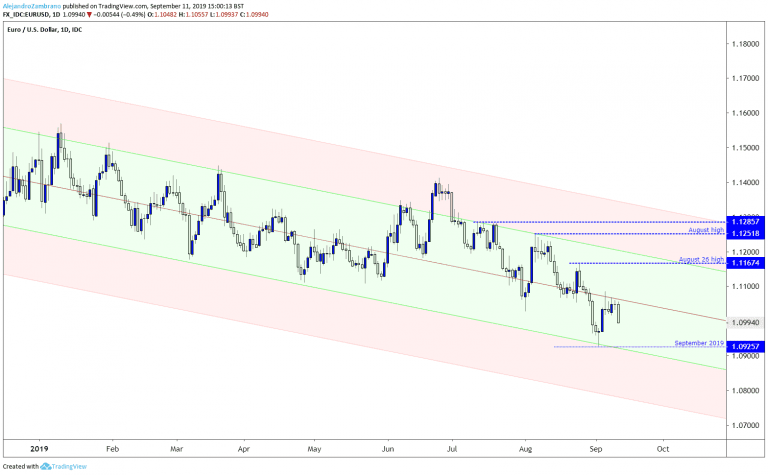

At the time of writing, the Euro (EURUSD) was down by 51 pips vs. the US Dollar, as traders appear to position themselves for a dovish outcome at tomorrow’s ECB rate meeting. The price turned lower after reaching the median line that has dominated EURUSD price action since October 2018.

The next support level and a potential profit target of bearish traders is the September 2019 low at 1.0925, which is also a level near the green downward sloping trendline currently at 1.0920. The same trendline acted as support when EURUSD bounced from the 1.0925 level.

Don’t miss a beat! Follow us on Telegram and Twitter.

ECB Rate Meeting Expectations

On July 25, at the latest ECB rate meeting, the head of the central bank, Mario Draghi, hinted that more stimulative monetary policy could be introduced, and the markets are currently projecting that the ECB main rate will be reduced by 20 basis points to negative 60 bps. The EURUSD soften in the days following the latest rate meeting, but the losses were not sustained as the EURUSD price move has been somewhat erratic since May 2018. However, as for German government bond yields, they declined from -0.36 to reach a low of -0.75 on September 3 to currently trade at -0.558, as the bond market is pretty sure the European Central Bank will indeed do more to stimulate the economy.

The German economy has barely increased since last summer, and leading indicators suggest further weakness ahead, and both European inflation and inflation expectations are very low. The ECB is therefore anticipated to cut rates and possibly introduce a new quantitative easing (QE) program. It is not sure how the Euro will react, but the base case is that the downtrend will accelerate if the central bank indeed introduces more QE. The central bank is anticipated to resume asset purchases of about 45 to 60 billion Euros per month for the next twelve months.

However, if the ECB does not cut interest by 20 bps, and instead opt for a softer cut of 10 bps, and the QE program is less than 45 billion per month, we might see a surge in the EURUSD.

Technically, the short-term EURUSD downtrend will remain in place as long as the price trades below the August 26 high of 1.1167, and traders might short-sell if the price revisits the median line at 1.1061. If the lower green trendline does not act as support the price might reach the lower red downward sloping trend line currently just below the 1.08 level.

If the ECB disappoints the markets the EURUSD might test the August 26 high at 1.1167 followed by a test of the August high at 1.1251.