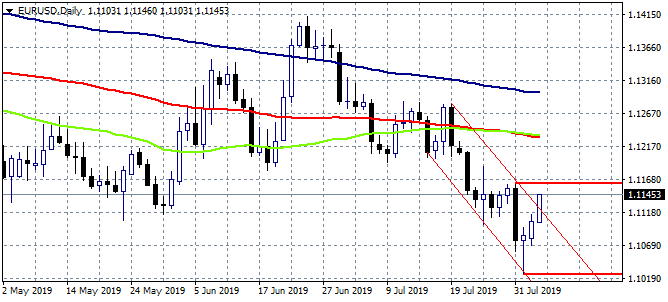

EURUSD starts the week breaking above the descending channel, as it adds 0.30 percent at 1.1140 amid mixed Services PMI from Eurozone countries; Germany Markit Services PMI came in at 54.5 below forecasts of 55.4 in July. France Markit Services PMI came in at 52.6 beating expectations of 52.2 in July.

EURUSD continues for third day the rebound from 1.1026 low as the US – China trade war intensifies. The pair which has trapped in the downward channel from mid July managed today to break above 1.1120 and to regain the short term positive momentum. In the hourly chart the bulls now are in control as the pair trades above all major hourly moving averages. A long position might be initiated targeting the 1.1165 high from June 31st. A narrow stop loss to 1.1120 must also be placed for reducing the downside risk as that will signal the return to the downtrend channel.

A short position targeting below 1.11 mark can initiated if the pair cross below 1.1122 the 200 hour moving average, with a stop loss order at 1.42 the daily high. In the case EURUSD breaks below 1.11 the downward move will accelerate down to 1.1026 and then at 1.0950.Don’t miss a beat! Follow us on Twitter.