The Euro (EURUSD) is under pressure this morning as news hit the wires saying that ECB staff are looking a potentially revamping the ECB inflation target. The report was published by Bloomberg news, and very few details were published.

Apparently, the staff at the ECB is trying to figure out if the ECB inflation target of 2% is still appropriate, and if the ECB should allow inflation to remain within a specified interval, and not capped at 2% as it is today.

If the bank would switch to a symmetrical approach then this would allow inflation to remain elevated for some time and this mean that the ECB would be less aggressive with reducing and removing quantitative easing when inflation is approaching the two percent target.

As an example, in 2018 inflation was above the 2% target, and the ECB were quick to close out their QE program. But inflation has now soften again and is at 1.2%, and the markets have started to price in rate cuts at the ECB September meeting.

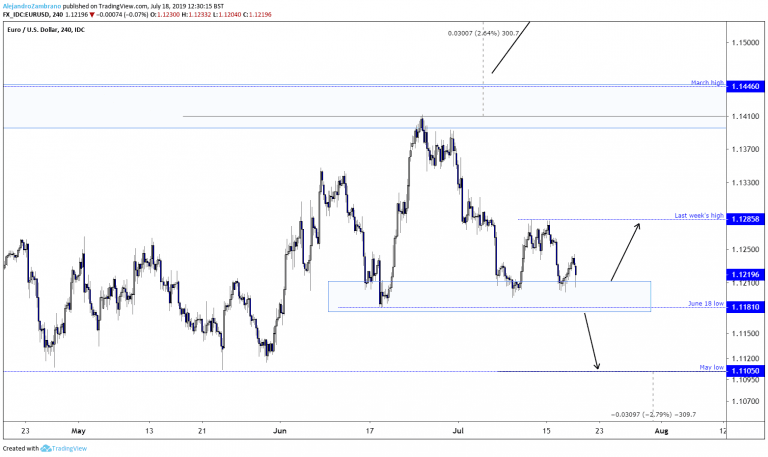

As a symmetrical target is less aggressive than the current policy the EURUSD slid back into support, but the price has managed to bounce back since then.

The nearest important support level is the 1.1181 level and as long as the price trades above this level the price might drift towards last week’s high of 1.1285, while a break to the 1.1181 low might send the price to the next support level and likewise May low of 1.1105.Don’t miss a beat! Follow us on Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.

Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.