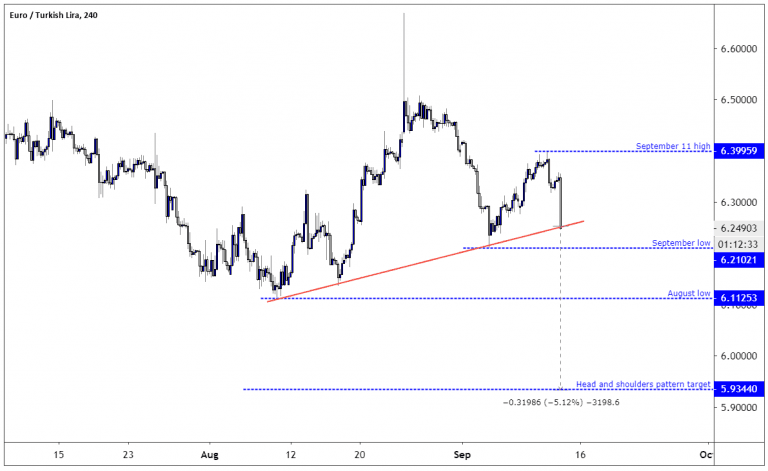

At the time of writing, the Turkish Lira was up by approximately 0.85% vs. the Euro as the Turkish Central Bank decided to reduce interest rates from 19.75% to 16.5%. The next support level in the EURTRY pair was the September low at 6.21, followed by the August low at 6.11. The downtrend in the EURTRY pair, i.e. the strength of the Turkish Lira, will remain in place as long as the EURTRY trades below the September 11 high of 6.39.

The price has also carved out a head and shoulders patterns over the last few days, and a break to the September low at 6.21 might set the trading pattern in motion, and it suggests that EURTRY might trade as low as 5.93.

Don’t miss a beat! Follow us on Telegram and Twitter.

The reduction in the interest rate was more than what the market was expecting. Traditionally, when a central bank cuts interest rate it tends to soften the country’s currency, however, in Turkey the interest rates have been very high for a long time, and this has hurt the economy so lowering interest rates should boost the Turkish economy. Cutting interest rates is therefore boosting the Turkish Lira vs the Euro and the American Dollar (USTRY).

The central bank interest rate spent most 2010 to 2018 in an interval between 4 to 10 percent, however, in 2018 the interest rates were increased to combat inflation, causing the interest rate to reach a high of 24% in early 2019.Inflation spent most of 2010 to 2017 between 5 and 11 percent, but when the Turkish currency declined in 2017 and 2018 inflation rose to above 25%. Inflation has moderated lately, and in August inflation was at 15.01%. The decline in inflation is allowing the central bank to cut interest rates.GDP annual growth over the same period was between 3 to 12 percent, with most of the growth being around 6 percent per year. However, as interest rates were increased in 2018 and 2019 the Turkish GDP growth contracted and reached a low of negative 3.2% in the first quarter of 2019.Download our latest quarterly market outlook for our longer-term trade ideas.

Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.