The EUR/USD pair is wavering today as investors eye the upcoming EU inflation and US nonfarm payroll numbers. The EURUSD is trading at 1.2322, which is a few pips below yesterday’s high of 1.2347.

What happened: In its monthly private payroll report, ADP said that the American economy lost more than 123,000 jobs in December in a sign that the economy was cooling. This performance was mostly due to the lockdowns states imposed last month.

The data came two days before the Labour Statistics Bureau is set to publish its nonfarm payrolls. Analysts are pessimistic about these numbers, with most of them predicting that the unemployment rate rose to 6.8% in December.

The EUR/USD is also reacting to the incoming stimulus in the United States after Democrats took control of congress. This month, there is therefore a possibility that the government will launch another large stimulus package.

What next: Today, the key data to watch will be the preliminary inflation data from the European Union, the minutes by the European Central Bank (ECB), and retail sales. These numbers will have no meaningful effect on the EUR/USD pair. Also, investors will react to the US jobless claims data.

EUR/USD signal

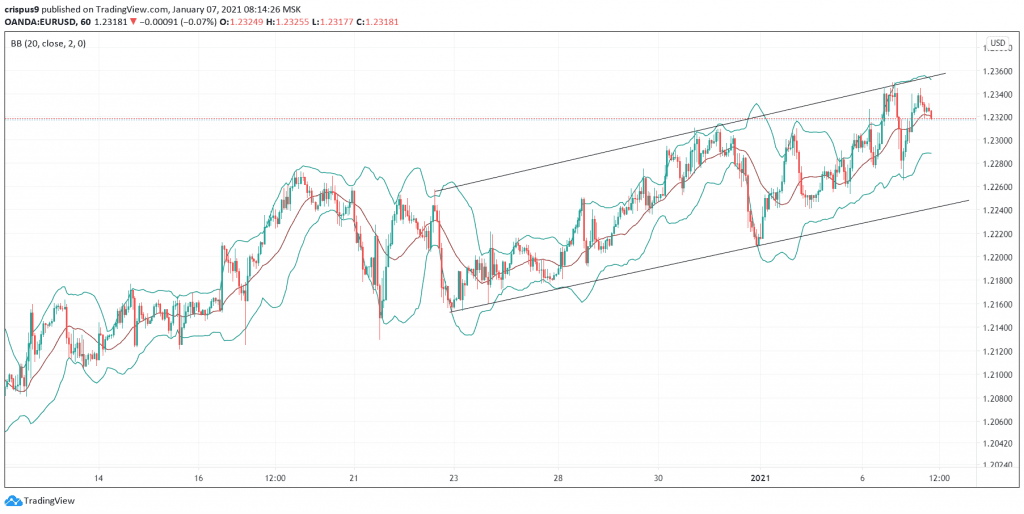

Turning to the hourly chart, we see that the EUR/USD pair has declined a bit. It has moved slightly below the upper side of the rising channel that is shown in black. Also, it has moved to the middle line of the Bollinger Bands.

Therefore, while the overall trend of the EURUSD is bullish, there is a possibility that bears will push it lower today. If this happens, the next level to watch will be the lower side of the channel at 1.2288. On the flip side, a move above 1.2340 will invalidate the bearish thesis.

Don’t miss a beat! Follow us on Telegram and Twitter.

EURUSD technical chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Crispus on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.