The EUR/USD pair is trading higher on the day, up by 0.13%, as the pair recovers some of Friday’s losses that were triggered by the stellar Non-Farm Payrolls report. The day’s uptick comes as the EU Sentix Investor Confidence Index came in slightly better than expected.

Economists had predicted a reading of -29.1, but the index came in at -25.2. This reading was also better than the -26.4 previous number. However, the German component of this index is at its lowest point in two years, which presents new concerns of a recession despite the slight improvement in the numbers.

The EUR/USD could face new headwinds after Rabobank posted a negative outlook for the pair, predicting a fall below parity in the weeks ahead. However, this outlook will depend on additional Euro-negative fundamentals hitting the wires.

This week’s fundamental triggers for the pair come mainly from the US inflation data. The headline and core consumer price indices are due on Wednesday, while the producer price index (m/m) is due on Thursday. The consensus is for the headline and core CPI to have dropped from 1.3% to 0.2% and from 0.7% to 0.5%, respectively.

The PPI prediction is for cooling from 1.1% to 0.3% monthly. The Industrial Production data for the Eurozone will cap the news releases with potential impact on the EUR/USD. The markets are expecting a 7-percentage point contraction.

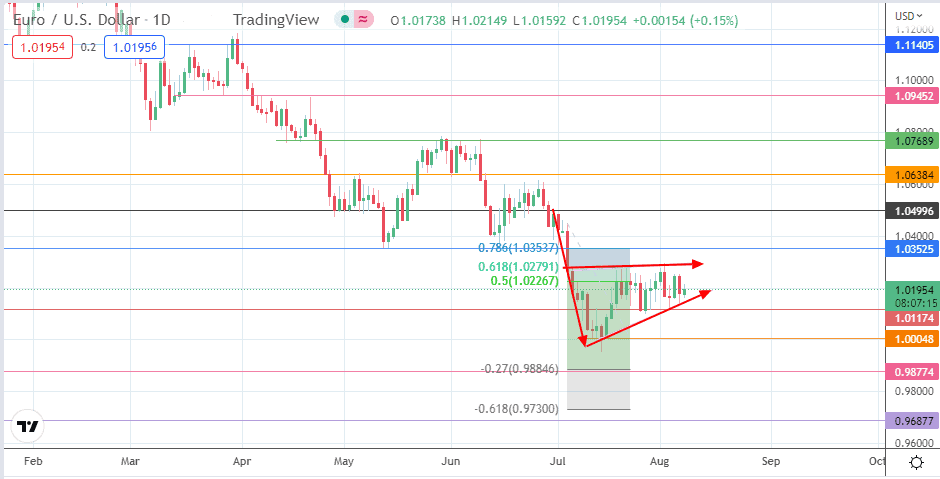

EUR/USD Forecast

The emerging pattern on the EUR/USD is that of a bearish pennant. A breakdown of this pattern throws up 0.96877 as the completion point of the measured move. This move would require a breakdown of the support levels at 1.00048 (12 July low) and 0.98774 (25 November 2002 low, just below the 27% Fibonacci extension level).

This outlook is only negated if fundamentals produce Euro strength, leading to a break of the 1.03522 resistance (12 May low). This move invalidates the pattern and brings the 1.04996 resistance (15 June 2022 high) into the mix. The 5 May high at 1.06384 and the 1.07689 barrier formed by the 27 May and 3 June 2022 highs constitutes additional targets to the north.

EUR/USD: Daily Chart