The EUR/CHF has resumed the downside this Friday, losing 0.27% following the 75 basis points rate hike by the Swiss National Bank on Thursday. The bullish action of the SNB caused a wild, choppy ride on the pair, causing initial losses on the EUR/CHF before the bulls clawed back to end the day 0.96% higher.

The rate increase by the Swiss National Bank is the second time the Swiss apex bank is raising rates in 15 years. The move also ends a decade of negative interest rates. The SNB has also said it cannot rule out more rate hikes in future. Despite the gains seen in the EUR/CHF pair, it still trades close to 7-and-a-half-year lows.

However, the Swiss Franc appears to have gained some tailwinds from the action this Friday at the expense of the weaker Euro, which has taken a hit from weaker Flash Manufacturing and Services PMI data.

German Flash Manufacturing PMI data for August came in at 48.3, which met the market consensus but represented a drop from the previous figure, which was revised downwards to 49.1. The German Flash Services PMI came in at 45.1, versus the previous figure of 47.7 and the consensus of 47.2. The contraction in business activity in the manufacturing and services sectors has led to the Euro being placed on offer, with the EUR/CHF taking a hit on the day.

EUR/CHF Forecast

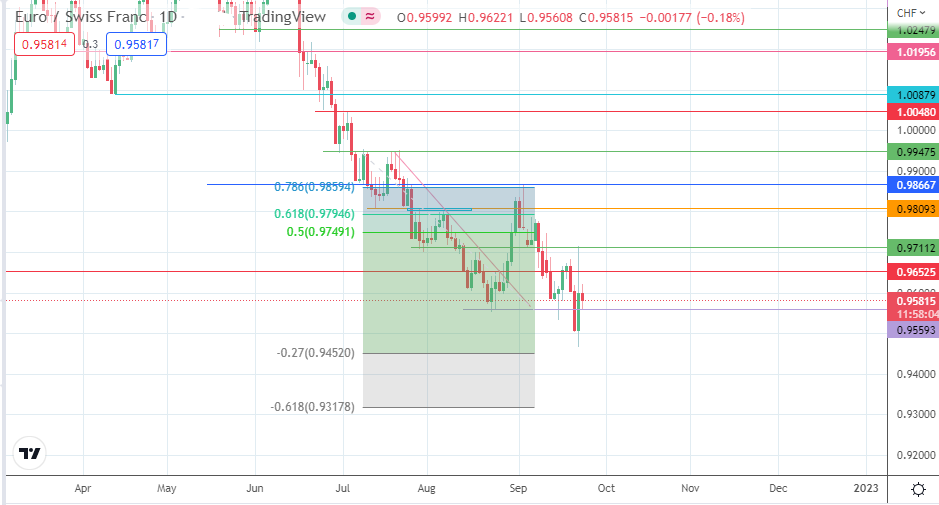

The EUR/CHF pair is now testing support at the 0.95593 price mark, following yesterday’s choppy price action. A breakdown of this support formed by the previous lows of 23/24 August 2022 opens the door for a retest of the 21 September 2022 low a 0.9503.

A breakdown of this price mark opens the door for the bears to aim for the 27% Fibonacci extension of the 8 July price high to the 23 August swing low at 0.94520. An additional harvest point potentially comes in at the 61.8% Fibonacci extension at 0.93178. The 0.94000 psychological support may also form an intervening pitstop.

On the flip side, recovery comes from a bounce on the 0.95593 support. This allows the pair to test the 0.96525 resistance (24 August high). If the bulls uncap this resistance, the 0.97112 resistance where the 5 September low and the 22 September high are found becomes the next upside target. Above this level, additional resistance barriers are seen at 0.98093 (28 July 2022 high) and 0.98667 (26 July 2022 and 2 September 2022 highs). 0.99475 also forms a potential harvest point for the bulls, being the site of previous highs of 11/21 July 2022.

EUR/CHF: Daily Chart