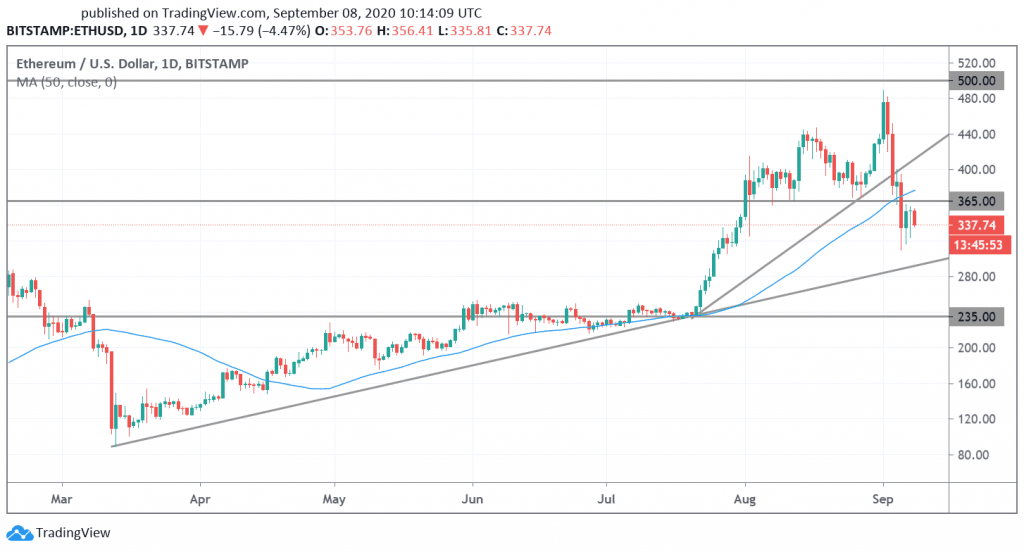

In my last article, Ethereum Falls Short of $500 – Further Lows Possible, I predicted that the market could drop further with key support at the $365 level. The move lower in Ethereum has been swift as the recent move higher in the U.S. dollar has taken the steam out of commodities and alternative assets.

The risk for cryptocurrencies is a further advance in the dollar, maybe driven by short-covering, which could see Ethereum drop further before it finds serious buyers.

The move higher in Ethereum was driven by a recent surge in Decentralized Finance (DeFi) projects, but the last two months saw the bull market expand with Bitcoin’s move against the U.S. dollar. The greenback’s drop boosted alternative assets such as gold, silver, and oil, and the cryptocurrency market was a key benefactor.

The latest speculative advance highlights the status of Bitcoin as a real financial asset and the price is moving based on the outlook for the U.S. dollar and the centralized financial system. Fears of runaway inflation and central bank money printing saw BTC explode higher and if you believe that the central banks are living on borrowed time then you need to get involved in cryptocurrencies on the current dip.

Ethereum Technical Outlook

Ethereum’s failure to take the $500 level has resulted in a deep sell-off to $337, which took out the key support around $365 which I noted in my last article. The next big support comes in around $300 with horizontal support at $235. A break above $365 is needed to continue the uptrend. A daily close lower today would be the first failed attempt at $365 and would see further losses.

Don’t miss a beat! Follow us on Telegram and Twitter.

Ethereum Daily Chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Kevin on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.