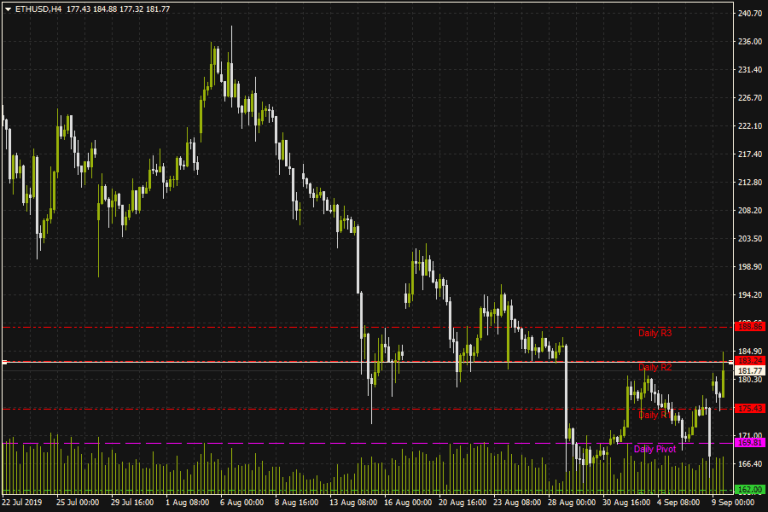

ETH/USD was able to push past the $180 mark in early Monday trading, getting some upside impetus to bounce from the 175.43 R1 pivot It is now testing the 183.24 price level (S2 pivot), which is the site of the September 3 high. This price level has at various times been the support and resistance on ETH, with some of these being in role reversal functions.

Technically speaking, ETHUSD continues to remain in a long-term downtrend and the sentiment is therefore bearish in the long term. However, there will be opportunities to sell on any rallies, and this latest burst may be one of such opportunities.

A compressed view of the 4-hour chart reveals that the price action candles are pushing against the R2 pivot, but the latest 4-hour candle has shown very low activity and has basically formed a doji candle. This may be sign that the upside burst seen today may have been shortlived.

A break above 183.24 will bring the 15 August high of 188.86 into focus; this is also the site of the R3 pivot. On the flip side, failure to breach the 183.24 price level could see price action retest 175.43 (August 15 low) and below this level, 169.81 (intraday low of September 6).Don’t miss a beat! Follow us on Telegram and Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.

Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.