EasyJet is down by 1.78 per cent in today’s trading session. Today also extends the last six trading sessions where Easy jet has been losing in the markets, resulting in a 13 per cent decline in market prices.

EasyJet Recent Struggles

Due to the ongoing challenging operating environment, EasyJet has been cancelling flights and disrupting the travelling of their customers. In a recent report by BBC, the company announced they would be cancelling 80 flights and apologized to their customers for the disruptions.

According to Transport Secretary Grant Shapps, the current EasyJet flight cancellations result from the understaffed aviation industry. However, Shapps admitted that, during the Covid-19 pandemic period, the industry cut too many jobs, and as services are returning to normal, most Aviation companies are overselling their flights.

Although we cannot tell how these flight cancellations have contributed to the current drop in prices, in most cases, a barrage of bad press translates to the markets. Therefore, it is likely that what we have seen for the past seven trading sessions, where the prices have dropped by 13 per cent.

However, based on what has been happening for the past few days, if the flight delays and cancellations continue, there is a high likelihood that the share prices will continue to fall. In addition, the profitability of the company will also be hit, which will result in EasyJet posting bad financial reports. The result of such situations is mostly investors taking their money out of a company, which can lead to the share prices continuing to fall.

EasyJet Share Price Prediction

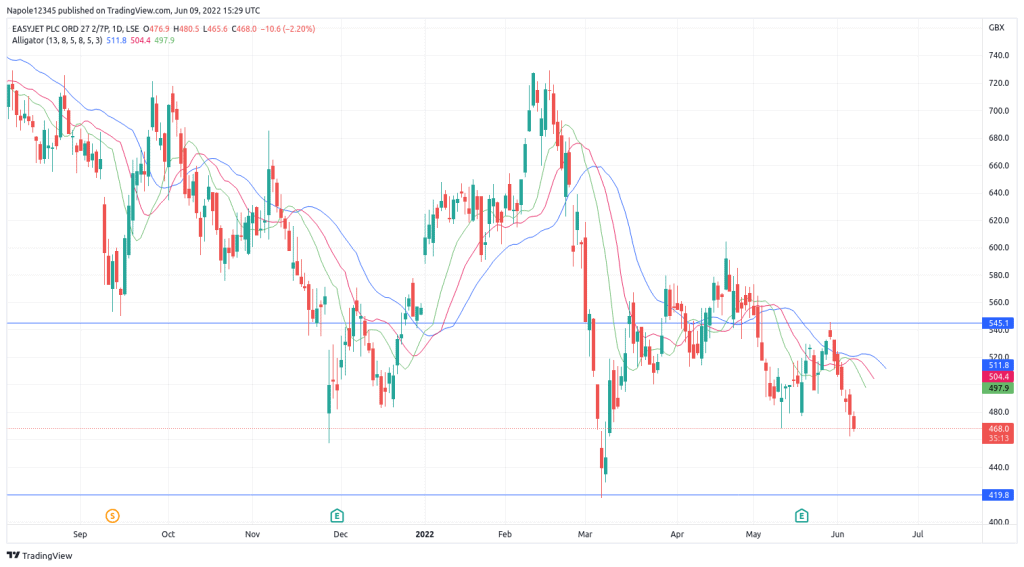

Based on the strong bearish trend resulting from the current market factors such as understaffing, I expect the bearish trend to continue. As a result, there is a high likelihood that we will see the prices trading below the 460p in the next few trading session.

If the company cannot correct the current problems resulting in flight cancellations quickly, then it is possible we will see the prices trading below 420p. However, improving market conditions will likely see my bearish trend analysis invalidated. IT will also be possible for EasyJet’s share price to trade above 500p.

EasyJet Daily Chart