US stocks declined yesterday as traders reacted to the FOMC decision and the weak economic numbers from the US. The Dow Jones declined by more than 130 points while the S&P 500 and Nasdaq 100 indices fell by 30 and 140 points, respectively. The three indexes are barely moved in the futures market.

In Asia, indices are largely in the green, with the Nikkei 225, Hang Seng, and Shanghai composite rising by 0.20%, 0.40%, and 1.80%, respectively. In Europe, futures tied to the DAX index are up by 0.30% while other key indices like the FTSE 100, CAC 40, and Stoxx 50 are down by more than 0.50%. This is despite the fact that several important deals have been announced today.

Earlier today, Caixabank and Bankia announced a merger that will create Spain’s biggest bank with more than $785 billion in assets. This deal came at a time when there is talks about other bank mergers in Europe. Early this week, we reported that there was talk about a merger of UBS and Credit Suisse, which would create the biggest bank in Switzerland.

In another deal, Ericsson said that it would spend $1.1 billion to acquire Cradlepoint, a company thar manufacturers wireless WAN products.

In currencies, the British pound declined against the dollar as traders reacted to the Bank of England interest rate decision. The bank left rates unchanged yesterday and said that negative rates were on the table if the economic conditions worsened. Meanwhile, the GBPUSD fell even after data released by ONS showed that retail sales rose by 0.8% in August. That was better than the 0.7% increase that analysts were expecting. The core retail sales jumped by more than 4.3%.

Elsewhere, the South African rand (USDZAR) continued its upward trend following the South African central bank rate decision. In Turkey, the Turkish lira dropped to the lowest level on record as sentiment soared. The fear and greed index, which is a good measure of sentiment in the market is dropped to 53, which is a neutral level.

Dow Jones technical forecast

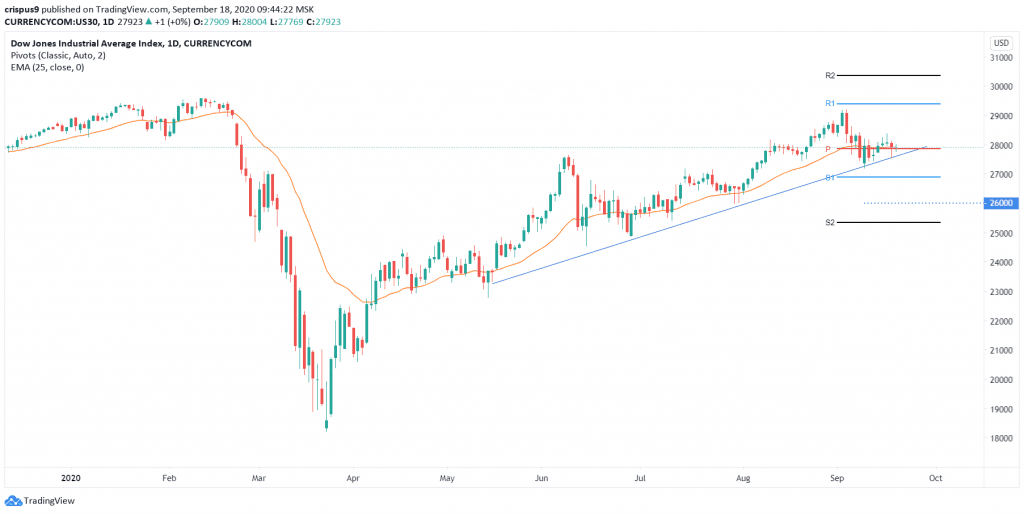

A look at the Dow Jones futures chart below shows several things. First, the index has been in a strong rally after falling to a low of $18,200 in March. It rose to the important resistance of $19,000 early this month. Second, the index is now trading exactly at the pivot point level. Third, it is also above the 50-day and 25-day moving averages. Most importantly, the Dow Jones is above the ascending trendline.

Therefore, I suspect that the index will resume the upward trend as bulls aim for the R1 at $29,450. On the flip side, a move below the ascending trendline will invalidate this trend. It will mean that bears have prevailed, which means that the Dow will likely fall to test the S1 at $26,933.

Don’t miss a beat! Follow us on Telegram and Twitter.

Dow Jones index daily chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Crispus on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.