As the US morning is underway, the Dow Jones Industrial Average future had risen by 32 basis points on the heels of a surge in European stock markets. The DAX 30 was up by 1.35% at the time of writing, while the CAC 40 was up by 0.7%.

As for the Dow Jones, the market remained supported as the Fed is about to reduce interest rates, and as US economy fared better than many have been expecting with Retail sales, Philly Fed, NAHB, and Empire state index outperforming economist expectations.

US Data Might Continue to Outperform

The Citi group economic surprise index is a measure that shows if US economic data is under or outperforming economists’ expectations. The index is long-term range-bound. In early 2018, the index peaked around the 80 marks, and it double-bottomed in 2019 around the minus 70 level, which is higher than the negative 80 experienced in 2017, but inline when with the levels where the index bottomed out in 2015, and 2012. As the indicator tends to mean-revert, it suggests that US economic data might continue to outperform, and this could support the Dow 30.

The sharp drop in interest rates ahead of the rate cut can explain why some economic indicators rebounded, as an example, the US ten-year government bond yield was now at 2.05% vs. the 3.24 % in October 2018.

Dow Jones Technical Outlook Remains Bullish

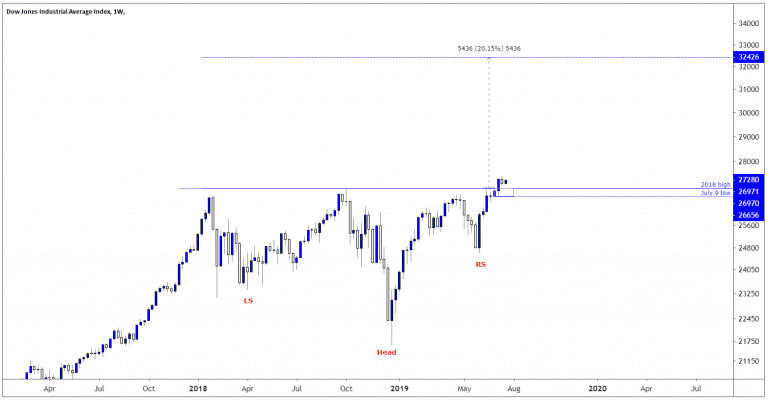

As for the Dow 30 technical outlook, it is still supporting higher prices, and an upbeat outlook. In the past, I reported that a break to the 2018 high of 26966 would trigger a major inverse head and shoulders pattern with a target of 32319. Some traders might debate if a reversal pattern makes sense here with the Dow near to its all-time high, but my practical experience of trading this pattern tells me that it works even in current conditions.

I don’t think the price will reach its target immediately but rather takes its time. The trend will remain bullish as long as the price trades above the July 9 low of 26665. In the short-term, the price is trying to take out its current all-time high of 27410, and if bullish traders are successful, it should accelerate the uptrend.

Facebook Earnings July 24: Download our free FB earnings preview report today.

Don’t miss a beat! Follow us on Twitter. Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.