The Dow Jones started the week lower after the latest index reshuffle with Salesforce, Honeywell, and Amgen all falling on their first day of trading in the industrial average.

The index changes saw Exxon Mobil, Raytheon, and Pfizer all demoted from the Dow on the same day that Wall Street stock splits by Tesla and Apple. Another factor in the bearish sentiment was an analyst downgrade of Walmart and the index was over 200 points lower on the day. The downgrade to the retailer was based on the thesis that lower unemployment benefits and disposable income will make the second half of the year less favorable.

ISM Manufacturing Data

Today brings the release of the ISM Manufacturing PMI, which highlights business sentiment in the manufacturing sector. The 50 figure is the difference between growth and contraction, and the market is looking for a higher figure than July with 54.5 expected. This could set the tone for the day in the Dow Jones and a good number would add further positivity to the strong manufacturing numbers out of China, which saw the fastest pace of orders in almost ten years.

Dow Jones Technical Outlook

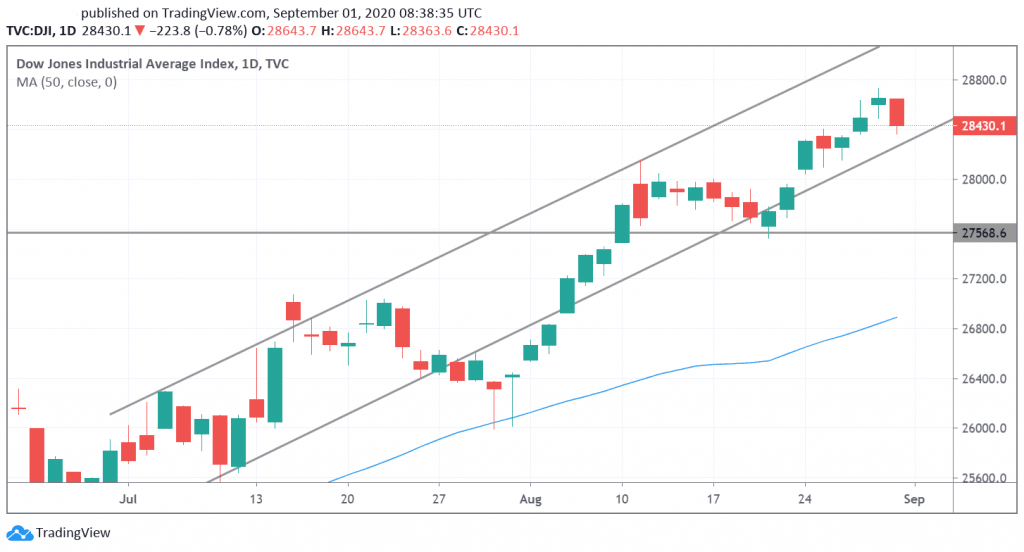

The 0.78% loss in the Dow Jones on Monday is still within the recent uptrend, but price channel resistance is close at 28,340. A break below this level could see a test of 28,000, and possibly 27.570. The 28,730 high on Friday would be resistance to break for further gains.

Don’t miss a beat! Follow us on Telegram and Twitter.

Dow Jones Daily Chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Kevin on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.