The Dow Jones index has struggled substantially in the past few weeks. The DJIA index has dropped by more than 5.45% from its highest level this year. It is trading at $34,580, which is slightly above this month’s low of $34,000. The index has risen by about 240 points in the futures market while the fear and greed index has crashed to 20.

There are several reasons why the Dow Jones index has lagged in the past few weeks. First, the Omicron variant has led many traders to worry about corporate growth. Still, I think that some of these concerns are unwarranted. Besides, American companies did relatively well at the height of the pandemic.

Second, the DJIA index has dropped because of the rising fears of higher interest rates. In a statement last week, Jerome Powell warned that the bank will embrace a more hawkish tone in the coming months.

Since it will meet next week, the bank will likely signal that it will end its taper program at a relatively faster pace. Again, there is a likelihood that stocks will do well even during a hawkish Fed because of the limited options that investors have about where to place their money.

Third, since the Dow Jones has done well this year, the current weakness is likely because of what is known as tax-loss harvesting. This is a situation where investors exit their loss-making trades with the goal of offsetting their taxes. It simply means that you subtract your losses from your gains.

The Dow Jones is rising today because of the positive moves on volatility. The CBOE VIX index has tumbled while the fear and greed index has moved to the extreme fear zone of 20. Historically, this drop tends to lead to significant gains.

Dow Jones forecast

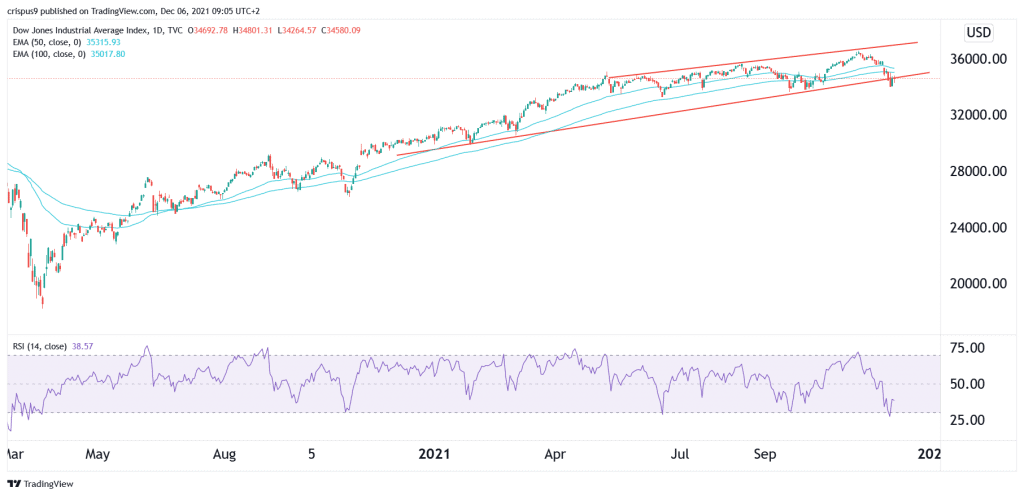

The Dow Jones index is trading at $34,580. This price is still above the lower side of the ascending channel that is shown in red. It has also moved slightly below the 50-day and 25-day moving average while the Relative Strength Index (RSI) has moved to the oversold level.

Therefore, there is a likelihood that the index will bounce back this week as investors attempt to buy the dips. The target for the index is the upper side of the channel at around $36,500. On the flip side, a drop below the lower channel will invalidate this view.