The Dow Jones was slightly higher last week after testing a key support level but there is still a threat of further downside with some key economic events ahead for the U.S. economy. Dow futures are pointing to a strong open with a gain of 0.64%.

Wednesday sees the release of retail sales with the market expecting a monthly increase of 1.1% after last month’s 1.2% gain. The U.S. economy is heavily-dependent on consumers and this should give traders a good idea about the health of the economy and the potential for stock revenues in the months ahead.

The same day will also see a Federal Reserve interest rate decision and the release of their economic projections. Former Fed Chair Alan Greenspan told CNBC last week that he thought budget deficits and inflation were problems for the U.S. economy.

Greenspan said: “We’ve got to resolve the budget deficits that are getting out of hand. All in all my major concern is inflation. It obviously hasn’t emerged in any significant way as yet, but I think that’s the area where our problems lie.”

The latest inflation figures for the U.S. saw a 1.3% print and this will be a key indicator to watch going forward. The Federal Reserve may provide more insight this week into the themes discussed by Mr Greenspan.

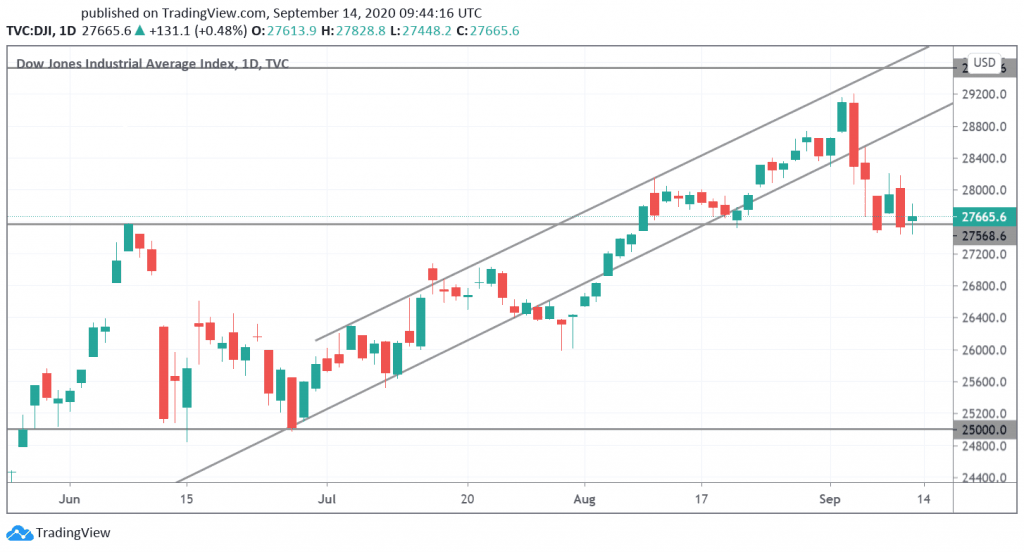

Dow Jones Technical Outlook

The Dow Jones tested the support level near 27,600 and this should be a pivotal week for the path ahead. If further lows are coming then the economic events will force the market below the 27,600 level with downside possible to the 26,000 price level. Resistance at 28,000 is the obstacle to try and retest the September 3rd highs. The Investing Cube team is currently available for one-to-one Trading Coaching. More details are available here.

Don’t miss a beat! Follow us on Telegram and Twitter.

Dow Jones Daily Chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Kevin on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.