The Diageo share price has been in a tight range in the past few weeks as investors assess the company’s growth prospects. The DGE stock is trading at 3,600p, which is about 12% below the highest point this year, meaning that it has moved into a correction level. Still, the share price is about 48% above the lowest level in 2020.

Diageo is a leading company that manufacturers some of the best-known beer, wine, and spirits brands in the world. Some of its best-known brands are Guinness, Smirnoff, Baileys, and Ciroc among others. The firm operates globally.

Diageo latest news

Surprisingly, the Covid-19 pandemic did not hurt Diageo as most analysts were expecting. Indeed, its revenue has been a bit stable in the past few years. Its annual revenue in 2020 was $14.6 billion, about $2 billion below its previous year. In 2021, its revenue bounced back to more than $17.6 billion. This explains why the Diageo share price has done better than most companies in the FTSE 100.

While Diageo stock has risen in the past few months, its valuation is a bit stable. The company has a total market cap of more than $110 billion and a dividend yield of about 2.05%. It has a trailing and forward PE ratio of 27, which is lower than that of Brown-Forman and Anheuser-Busch.

According to Simply Wall Street, a closer look at the company’s free cash flow shows that it is a bit cheap. In their estimation, they believe that the fair value is about 4,700p, which is about 25% above the current level. At the same time, analysts are optimistic about the DGE share price, with their average target of 4,280p.

Diageo share price forecast

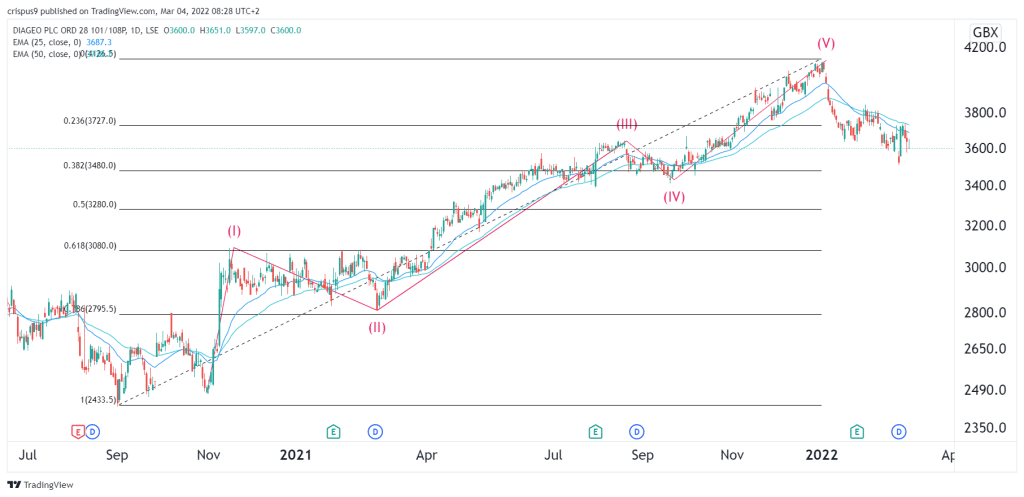

A closer look at the daily chart shows that the DGE stock price has formed a perfect Elliot wave pattern. It has already completed the first wave of this pattern. Now, it seems to be in a corrective wave. It is trading slightly above the 38.2% Fibonacci retracement level.

Therefore, while the stock could see some pain soon, it is likely to bounce back soon. If it does, the next reference level to watch will be at 4,145p, which is the year-to-date high. This view will be invalidated if the stock moves below the 50% retracement level at 3,280p.