The DAX index has rebounded sharply this week as concerns of the Omicron variant ease. It ended Tuesday at 15,815, which was a few points below its all-time high. It has also jumped by about 0.25% in the futures market. Focus now shifts to Olaf Scholz, who will become the new chancellor today.

Germany will see its first leadership change in about 16 years as Olaf Scholz becomes the next chancellor. He became so by forming a coalition agreement with the green and pro-business liberal party.

So, how will his new job impact the DAX index? Under Angela Merkel, the blue-chip index rose by about 277%. While this was a good performance, the index lagged its American peers like the Dow Jones and the Nasdaq 100 index.

It will be a bit difficult for the DAX to outperform during Scholz leadership. For one, many of the biggest companies in Germany are facing significant pressures. For example, during Merkel’s leadership, auto companies like Daimler, BMW, and VW flourished. Now, they are facing significant competition from the likes of Tesla, Lucid, Rivian, and Nio.

At the same time, in Merkel’s leadership, the country struggled to become a technology leader. And tech is what has supercharged the American economy. Indeed, the tech firms in the DAX 40 index are relatively small when compared to their American counterparts. They include Delivery Hero, Hello Fresh, and SAP. Therefore, Scholz has a difficult task ahead.

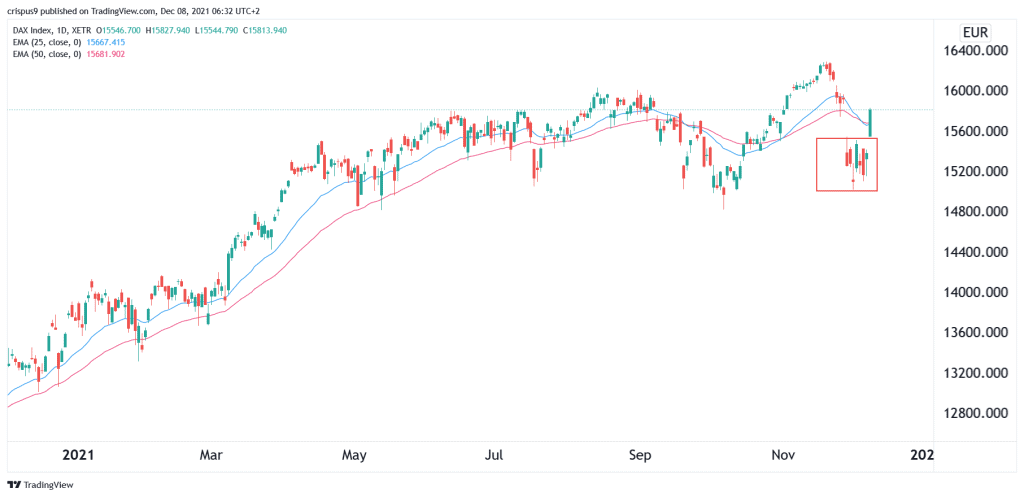

DAX index forecast

The daily chart shows that the DAX formed an island reversal pattern last recently after the Omicron variant illness was announced. This pattern is shown in red below. It has then bounced back and is currently trading at 15,815. It is about 3% below its all-time high. Also, it has risen above the 25-day and 50-day moving averages.

Therefore, there is a likelihood that the DAX index will keep rising and retest its all-time high in the coming days. This view will be invalidated if the index retreats below the key support at 15,300.