The DAX index is up by more than 0.50% today as traders react to the corporate deals that were announced during the weekend. Other European indices are also in the green, with the CAC 40, Stoxx 50, and FTSE 100 rising by more than 0.40%.

The DAX is rising in reaction to the ongoing corporate deals. Over the weekend, EP Global, an investment firm owned by Daniel Kretinsky said that it would attempt to acquire Metro, a leading retail chain in Germany. The fund, which owns about 30% of the firm, offered to acquire the remaining shares for €8.28%. That is a 2% premium from the Friday’s closing price.

Elsewhere, Softbank decided to sell its Arm business to Nvidia in a deal valued at more than $40 billion. The company is itself considering going private. In the United States, Gilead is expected to acquire Immunomedics in a deal valued at more than $21 billion. At the same time, Oracle won a deal to acquire Tik Tok’s America’s operations.

The new wave of corporate deals come in a week that several technology companies like Palantir Technologies, Unity, and JFrog are going public this week.

No DAX index constituent has been mentioned in the current wave of corporate deals. However, the transactions have helped boost confidence in the market, which is a good thing for the index.

Similarly, the index is rising because of the possibility that a coronavirus vaccine will be unveiled in the coming months. Over the weekend, AstraZeneca announced that it was resuming its trial while Pfizer announced that it will likely be selling the shots by the end of the year.

The biggest movers in the DAX index are MTU Aero, Adidas, BASF, Covestro, and Merck. These shares are up by more than 1%. On the other hand, the only companies in the red are Fresenius, Deutsche Boerse, Vonovia, and Deutsche Post.

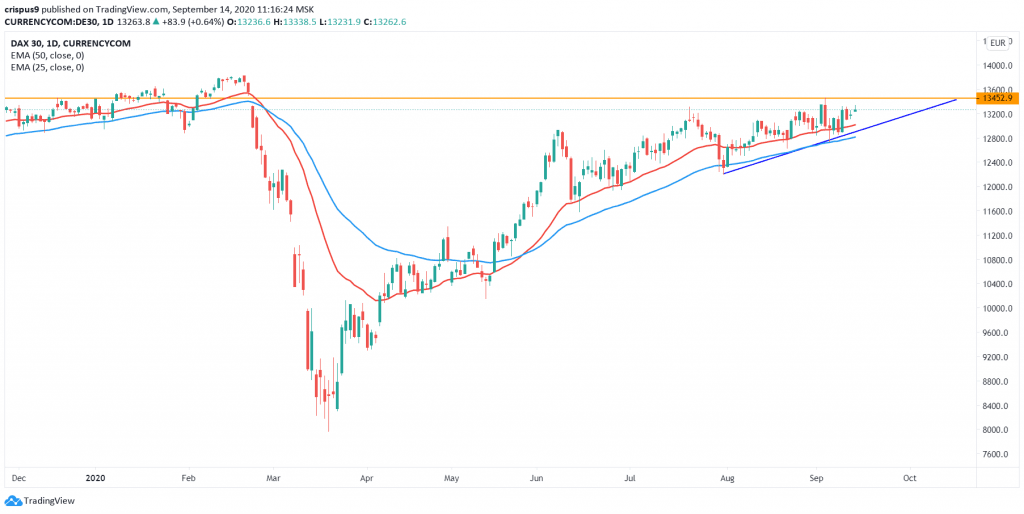

DAX Index technical outlook

The DAX index is trading at €13,270, which is slightly below today’s high of €13,340. The price is above the blue ascending trendline. The price is slightly above the 50-day and 100-day exponential moving averages. It is also forming an ascending triangle pattern, which has the upper resistance at €13,452.

This triangle is not close to the confluence zone. This means that, in the short term, the price will likely continue moving in a sideways direction. I suspect that it will break out higher in the next few weeks. On the flip side, a move below €12,735 will invalidate this trend. This price is the lowest level on September 4 and is also along the ascending trendline.

Start your trading journey with our free forex trading course and one-on-one coaching by traders and analysts with decades of experience in the industry.

Don’t miss a beat! Follow us on Telegram and Twitter.

DAX technical chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Crispus on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.