The DAX index is leading European stock markets higher with a 1.3% gain after the index followed U.S. stocks lower on Monday. The Dow Jones fell 0.78% and the S&P500 was down 0.22% after a big day of change on Wall Street.

The reshuffle of the Dow Jones index came onto effect on Monday, with Salesforce, Honeywell, and Amgen joining the 27 other companies that make up the industrial average. All three of those new companies were lower on the day, whilst an analyst downgrade of Walmart also weighed on the market.

Today’s gains in the DAX sees the index jump back above the 13,100 figure after three-straight days of losses. Asian stocks were higher this morning after Chinese factory orders registered their fastest growth in ten years during August, which is helping risk sentiment this morning, but European stocks may soon start looking closer to home for sentiment with the continent getting closer to the annual flu season.

New cases in Europe were seen in all of the major countries with France and Spain seeing the highest level at 3,082 and 2,489 respectively. Italy, Germany, and the U.K. all had between 1,000 to 1,500. Increasing numbers could start to see nerves about further lockdowns or restrictions and this could get worse as we get further into September and October. This morning sees German unemployment figures released, with the market expecting 1k jobs created in Europe’s largest economy, compared to a loss of 18k in July. The data should be key for the direction of the DAX for the rest of the day.

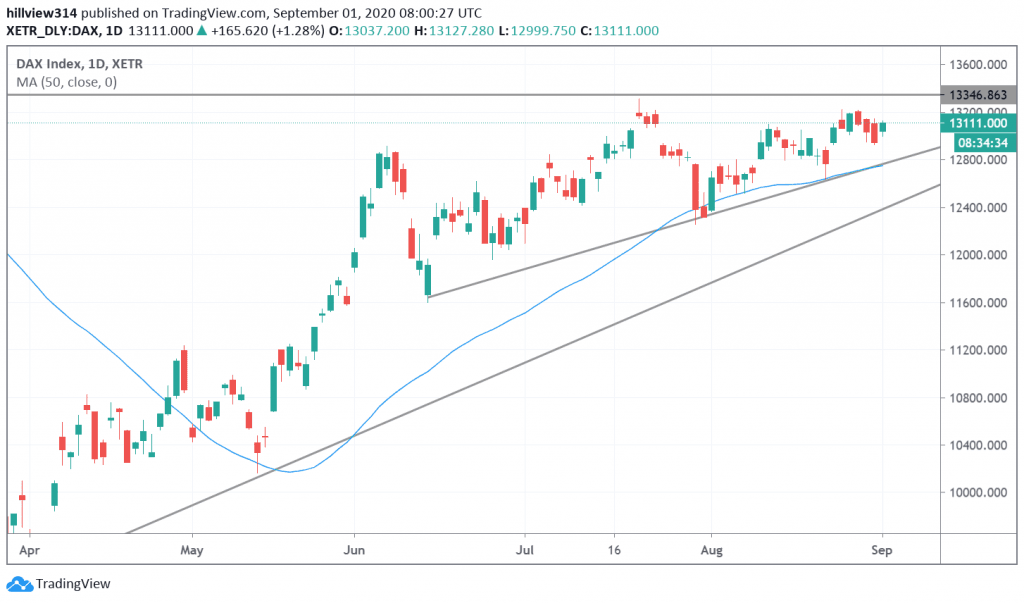

DAX Technical Outlook

The DAX is currently trading at 13,117 as it awaits the jobs number and support lies at 12,700. A break lower would open up a drop to 12,400 support levels. The 13,200 level capped last week’s gains and stop losses would be placed above there for shorts.

Don’t miss a beat! Follow us on Telegram and Twitter.

Dax Index Daily Chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Kevin on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.