Dash price has staged a strong comeback in the past few days. It has risen in the past two consecutive days and is currently trading at the highest point since September 7th. As a result, its market capitalization has jumped to more than $2.2 billion.

Dash fundamental analysis

Dash is a cryptocurrency with a common goal like Bitcoin and Litecoin. It enables people to send money in a faster way. It differs from Bitcoin because of its focus on privacy. Like Monero, transactions performed in Dash are hard to track.

Dash is widely used today. In the second quarter of this year, the network handled transactions worth more than $6.48 billion. It had more than 90,800 daily active addresses. On average, it handles more than 30,000 transactions.

In addition to privacy, Dash transactions are significantly cheaper than those of Bitcoin and Litecoin. It is also faster, with most of its transactions taking less than 1 second to complete.

The Dash price is rising after developers announced the Dash Platform v0.21 on testnet. The release improved several cryptographic proofs improvements and brought comprehensive error codes. The developers hope to shift the updates to the mainnet in the near term.

Dash price prediction

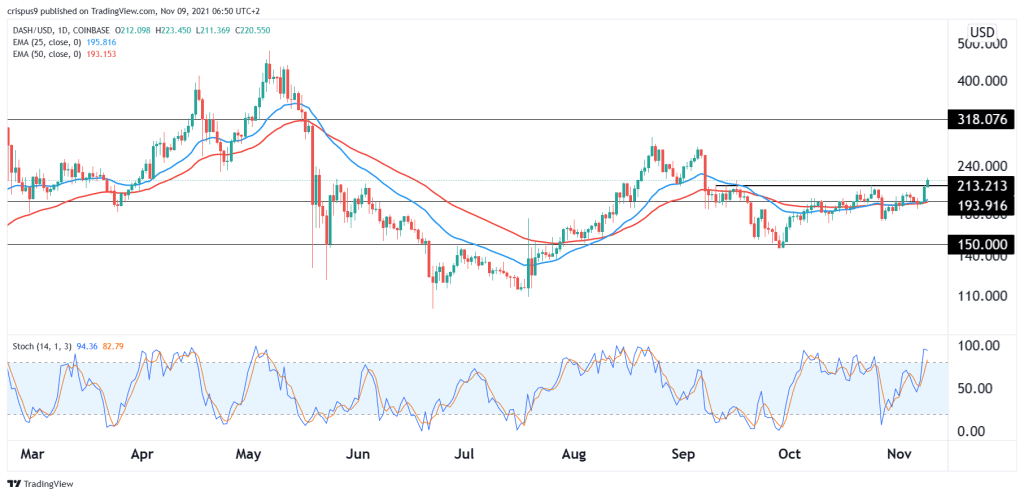

The Dash price has rebounded recently It has risen in the past three straight days. This rally coincides with the overall performance of Bitcoin and other cryptocurrencies.

On the daily chart, the price has moved above the key resistance level at $213, which was the highest level on October 24th. It has also risen above the 25-day moving average while the Stochastic Oscillator is approaching its overbought level.

Therefore, the path of the least resistance for Dash is in the upside, with the next key level to watch is at $280. This price is about 30% above the current level. This view will be invalidated if the price drops below the support at $200