Brent Crude oil prices ended the week lower by 5.66% from their weekly high, but these losses might quickly be reversed as drone strikes halt 50% of Saudi crude oil production.

Saudi Arabia is the world’s biggest producer of crude oil and contributes to 10% of world production. Fifty percent of their output was still potentially halted on Saturday evening according to the Saudi interior ministry, and that means that 5% of world production was offline.

Two facilities were attacked, Abqaiq and the Khurais oilfield. Abqaiq is situated in the Eastern Province of Saudi Arabia and is the world’s largest oil processing plant.

On February 24, 2006, al-Qaeda attempted to attack the facility, with one car bomb going off at the outer perimeter, and a second one exploding in the parking lot. That time the damage was contained, but crude oil price still soared by 2 dollars per barrel according to Washington, DC, based Center for Strategic and International Studies. If a similar jump in crude oil prices occur as trading opens for the new week, the crude oil price would be trading at $62.15, from Friday’s close of $60.15. However, it is likely that crude oil volatility will be higher this time around as the Khurais oilfield have also been attacked and the kingdom has clearly stated that up to 5 million barrels of production per day had been affected by the attacks.

The fires ravaging the facilities are so strong that they can be seen from space in pictures by Nasa Worldview.

Don’t miss a beat! Follow us on Telegram and Twitter.

[vc_column_inner width=”1/2″][vc_column_inner width=”1/2″]Source: https://worldview.earthdata.nasa.gov/

ATFX’s UAE based Head of Research, Ramy Abouzaid, said:

“This is the first time an attack of this severe damage has taken place on one of the biggest oil facility in the world which is producing about 5 million barrels. This makes this dangerous development a major impact on oil prices. But this, of course, depends on how much losses Aramco will announce. Also, because this incident happened over the weekend, it depends on developments in the coming hours and before the opening of markets.”

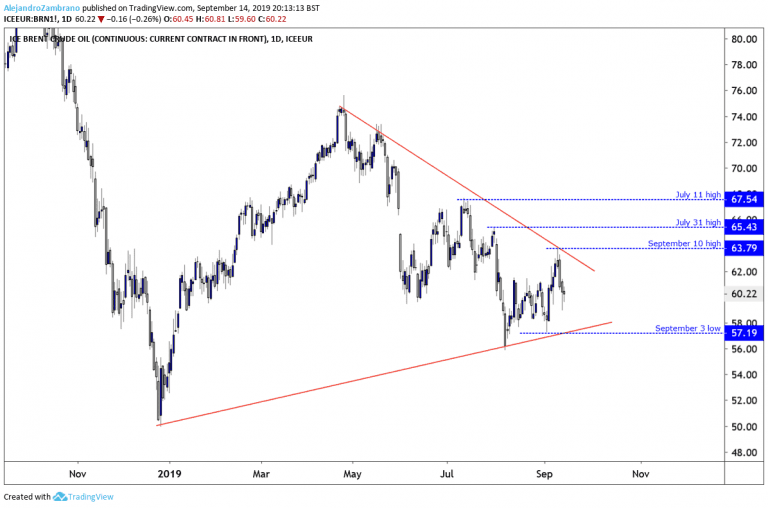

Technically, the volatility in the Brent crude oil price has been declining in the last few months, and one could argue that the price is trapped in a triangle pattern. The price tried to break out higher last week, but the price ended back into its old range. If the markets break the September 10 high of $63.79 as the markets open for the new week it might confirm a breakout of the triangle, and could potentially send the price higher by about 12.79 dollars per contract in the months ahead.

Short-term resistance levels are the July 31 high of 65.43, followed by the July 11 high of $67.54. On a failure of price to take out the September 10 high, it is fair to assume that crude oil prices will trade sideways between $57.19 – $63.79.

Don’t miss a beat! Follow us on Telegram and Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.

Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.