New lockdowns in China amid rising coronavirus cases in the Hebei province have prompted a selloff in risky assets.

Crude oil price on the Brent crude benchmark fell 1.94% on Monday, amid a firmer US Dollar as well as new lockdowns across Europe and China.

The new lockdowns are some of the strictest since the first lockdowns began in April/May 2020. Crude oil price was only propped up by several OPEC + output cuts in 2020, but the year ended with lower 2021 demand forecasts from OPEC. If new lockdowns kick in and demand is further diminished, experts fear that mere output cuts may not be sufficient to prop up crude oil prices.

Technical Levels to Watch

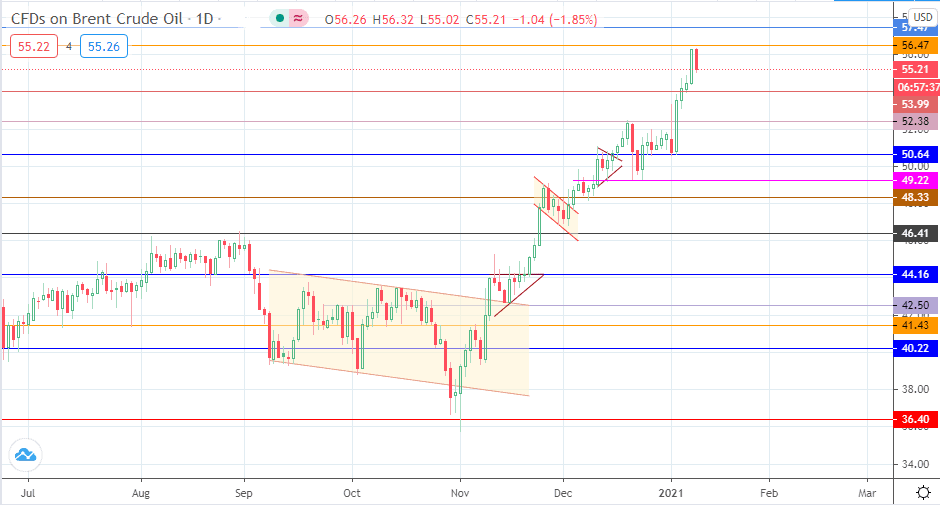

After falling short of the 56.47 resistance, crude oil price on the Brent benchmark is now on its way to the 53.99 support level. A breakdown at this point opens the door towards 52.38, with 50.64 also lining up as a potential support line.

On the flip side, a bounce on the 53.99 support area allows buyers to retest resistance at 56.47. 57.47 is a probable resistance target that would confront buyers if 56.47 gives way.

Don’t miss a beat! Follow us on Telegram and Twitter.

Brent Crude Oil Price; Daily Chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Eno on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.