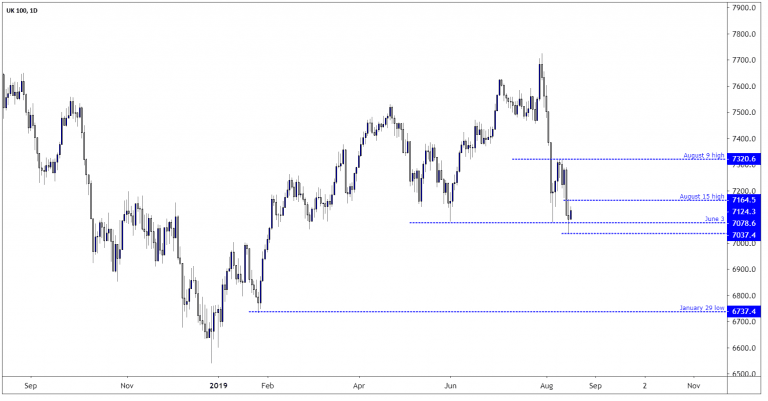

The FTSE 100 is under pressure and yesterday the stock index slid below the June 3 low of 7078.6. However, before the day ended the price was back up above the support level and managed to negate a bearish signal. If the market had closed below the June low, it would have been a bearish signal for traders, and the next support level and a potential profit target of traders would have been the January 29 low of 6737.4. The bearish scenario might still be triggered if the FTSE 100 closes below yesterday’s low of 7037.4.

The next few days will, therefore, be interesting for the FTSE 100. Either the stock index slide below yesterday’s low and triggers the bearish outlook, or the price manages to trade above the August 15 high of 7164.5, and the short-term bearish pressure will abate. On a break to the August 15 high, the price could start to trade sideways between the August 9 high of 7320 and yesterday’s low of 7037.4. For the multi-week trend to turn upwards, the price would need to close above the August 9 high.

Don’t miss a beat! Follow us on Telegram and Twitter.

Weighing on stock markets globally is the lack of progress in the talks between the US and China on trade matters. Also, the latest figures from Germany and the UK shows that both economies contracted in the second quarter. Finally, economic indicators such as the Sentix index shows that Germany and Euro Area economic activity has slowed further in the 3Q quarter. The same is anticipated for the UK as people slow down their spending head of Brexit on October 31. As the economies slow down, it will be difficult for stock markets to rise.