The drop over the cliff that Bitcoin and other altcoins suffered on Monday is fuelling bearish Coinbase stock price predictions. These predictions have seen Coinbase shares sold off massively, with an 11% drop recorded in Monday’s trading session. Daily trading volume on the Coinbase Global stocks also rose from a median of 10 million shares to top 21 million shares.

Coinbase stock price predictions have never really been bullish since the stock was listed on Nasdaq in April 2021. The highest the stock has ever attained was $429.54. It now trades at 1/8th of that value in a little over a year down the road. The collapse of the stock mirrors the downturn in the crypto market, with most of the losses starting in mid-November when the onset of the Omicron COVID-19 variant triggered a market selloff.

Earlier in the month, the company announced it was extending a hiring moratorium for new and backfill positions well into the foreseeable future. It also cancelled several accepted offers, with exceptions to ” mission-critical ” positions.

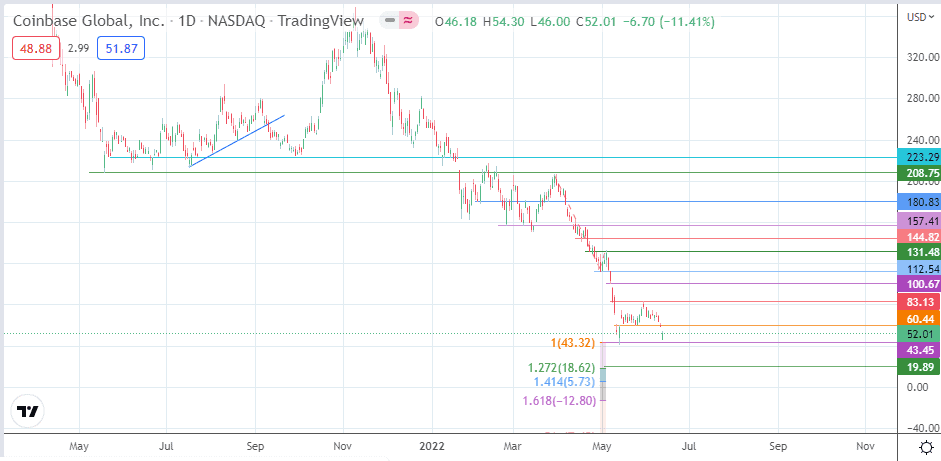

Technically speaking, a recent rally to the resistance at $83.13 served as a point to initiate new shorts, which sent the price to its current levels just above the $52 support. So here is how Coinbase stock price predictions are likely to play out.

Coinbase Stock Price Prediction

The downside gap seen on Monday was not fully covered, leaving the stock short of the 60.44 resistance. The bulls must break this barrier for gap coverage to occur. This scenario also gives access to the 83.13 resistance (31 May 2022 high). Additional hurdles to the north are seen at 100.67 (6 May low) and 112.54 (5 May low).

On the flip side, rejection at the 60.44 resistance puts the support at 52.01 under pressure. If the support collapses under selling pressure, 43.45 (12 May low and 100% Fibonacci extension) becomes the new downside target. Potential targets below this level lie at the 127.2% Fibonacci extension (18.62) and the 141.4% Fibonacci extension at 5.73.

COIN: Daily Chart