AUDUSD trades 0.17 percent higher at 0.7032 making new daily high after Chinese data beat analysts’ expectations. The China Industrial Production (year over year) came in at 6.3% above forecasts of 5.2% in June. The China Gross Domestic Product (year over year) matched expectations of 6.2% for 2Q 2019. China Gross Domestic Product (quarter over quarter) came in at 1.6%, better than forecasts of 1.5% in 2Q. The China Retail Sales (year over year) came in at 9.8%, beating expectations of 8.3% in June.

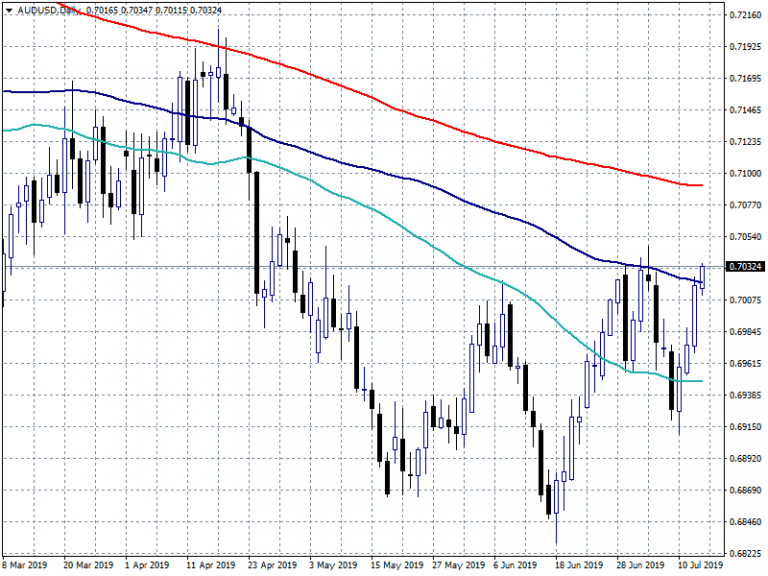

AUDUSD currently is trading above the 100 day moving average to 0.7033 and building on positive momentum targeting now the next resistance at 0.7090 the 200 day moving average. On the downside first support now stands at 0.7020 the 100 day moving average at 0.6948 the 50 day moving average. As Eno Eteng wrote last Friday this trading week promises to be a big week for the Australian Dollar. On Tuesday July 16, we have the Monetary Policy Committee’s minutes, which will indicate the tone and voting pattern of the last MPC meeting in deciding Australia’s interest rates. Then on Thursday July 19, the Australian employment data will hit the market and drive the AUDUSD price. Traders have to be cautious as the risk events will hit the wires.Don’t miss a beat! Follow us on Twitter.