Caterpillar’s share price has recently retreated as investors focus on the ongoing geopolitical events. The CAT stock is trading at $216, a few points below last month’s high of $227. However, this price is about 20% higher than the year-to-date low, bringing the firm’s valuation to about $117 billion. So, is Caterpillar a good investment?

Caterpillar is a global company that manufactures some of the most popular construction and mining equipment. As a result, it is a member of the Dow Jones index and one of the best gauges of economic growth. In most cases, the company does well when the economy is doing well since it means higher demand for its products like tippers, power units, and excavators, among others. This explains why the firm’s revenue crashed from $50 billion in 2019 to $39 billion in 2020.

The Caterpillar share price is wavering as concerns about the global economy remain. Analysts are concerned that we are heading to a recession now that the yield curve has inverted to the lowest point in more than a decade. Also, data published this week showed that the manufacturing sector is struggling as supply chain challenges remain.

Still, Caterpillar is benefiting from the American infrastructure spending and the rising commodity prices. The latter will lead to more demand for its mining equipment. The next key catalyst for the CAT stock price will be the upcoming earnings scheduled for the 28th of this month. Analysts expect the data to show that revenue rose to $13.48 billion while EPS rose to $2.56.

Caterpillar share price forecast

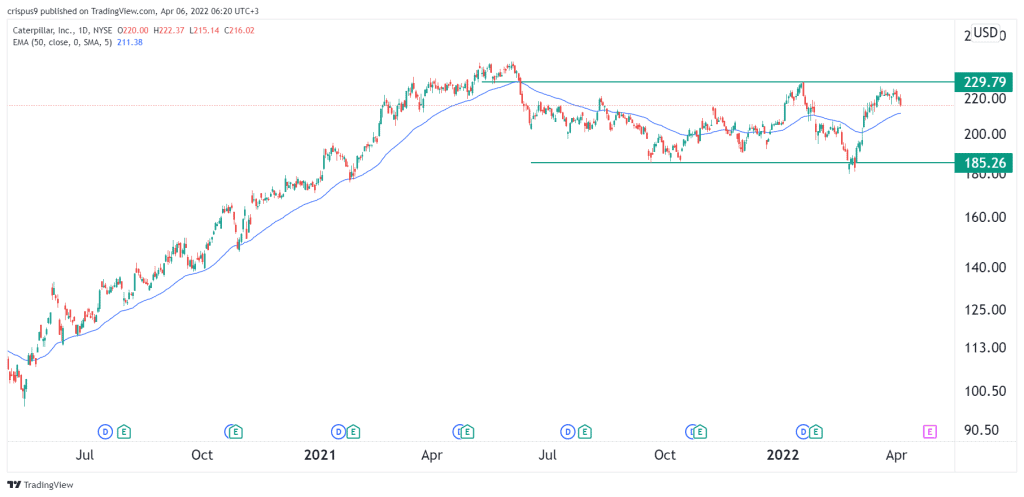

The daily chart shows that the CAT stock price has been stuck in a rage lately. It has struggled to move above the key resistance level at $229, the highest point this year. The stock has also moved slightly above the 25-day moving average. But it also seems to be forming a double-top pattern, which is a bearish sign.

Therefore, the outlook for the Caterpillar share price is neutral. Bulls must move above $230 to invalidate the double-top pattern. If they do this, the stock will retest the all-time high. Failure to do so will leave the stock vulnerable to a drop to about $185.