The Carnival share price is still embattled as the travel industry remains under pressure. The CCL stock is trading at 1,473p, which is about 8.62% below its highest month this month. It is also about 22% below its year-to-date high.

Travel Sector woes

The travel and leisure industry has not had a restart that most analysts and investors were expecting. Despite the recent trends in vaccination, the number of cruise ships at sea is still substantially lower than where it was before the pandemic

For example, Carnival, the biggest cruise line in the world, has only 8 ships carrying guests. The company also plans to increase the number of active boats to 15 by mid this year. The biggest risk for the company is that the number of breakthrough Covid cases keeps rising. As such, more potential customers may feel less safe taking a trip. Indeed, the number of Covid patients in cruises has risen recently.

So, is the Carnival share price a buy? In addition to the Covid situation, Carnival faces the risk of its high debt. The most recent data shows that the company’s total debt rose to more than $25 billion. It’s cash and short-term investments of more than $9.53 billion will provide a cushion until the industry makes a complete recovery.

Carnival share price forecast

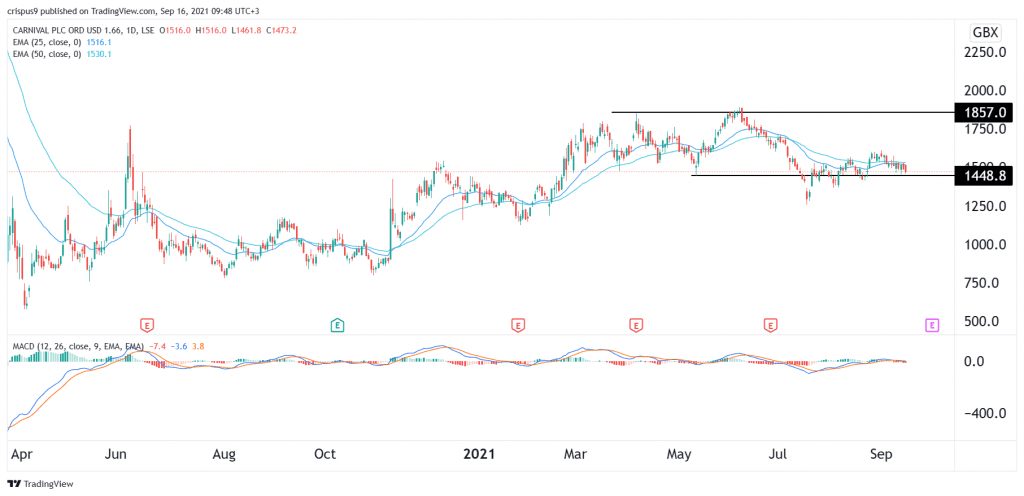

The daily chart shows that the Carnival share price has struggled lately. This performance coincides with the overall weak performance of other companies in the travel industry like EasyJet and IAG. Hospitality groups like Intercontinental have also struggled.

On the daily chart, the shares have moved slightly below the 25-day and 50-day exponential moving averages (EMA) while the MACD remains slightly below the neutral line.

The stock is also at the same level as the lowest level on May 12. It has also formed what looks like a bearish flag pattern that is shown in blue.

Therefore, the shares will likely break out lower in the next few days. If this happens, the next key support level will be at 1,257p, which was the lowest level in July. It is about 15% below the current level. On the flip side, a jump above this month’s high of 1,606p will invalidate the bearish view.