The CAD/JPY price rallied to the highest point since July 28 ahead of the upcoming Canada retail sales data. CAD to JPY exchange rate also rose after the the latest Japan consumer inflation data. It is trading at 105.10, which was about 3.57% from the lowest level in Augus.

Canada retail sales data

A divergence has emerged between the Bank of Canada (BoC) and Bank of Japan. Whereas the BoC has delivered several rate hikes, the BoJ has maintained a relatively dovish tone. It has maintained negative interest rates and hinted that it will continue easing.

Data published on Friday means that the bank has a room to maintain low interest rates. According to the statitics agency, the national consumer inflation rose from 2.4% in June to 2.6% in July. Excludingthe volatile food and energy prices, inflation rose from 2.2% to 2.4%. While these were the highest levels in more than a decade, they are slightly above the BoJ’s target of 2.0%.

The next key catalyst for the CAD/JPY price will be the upcoming Canada retail sales numbers. Economists expect the data to show that sales dropped from 2.2% to 0.3%. They also expect that core retail sales dropped from 1.9% to 0.9%. Retail sales have declined sharply in most countries because of the soaring inflation.

The CAD/JPY price has also risen because of the rebounding crude oil prices. Brent has risen to $96, which is higher than this week’s low of $90 even as signs of more weakness of the global economy remain.

CAD/JPY forecast

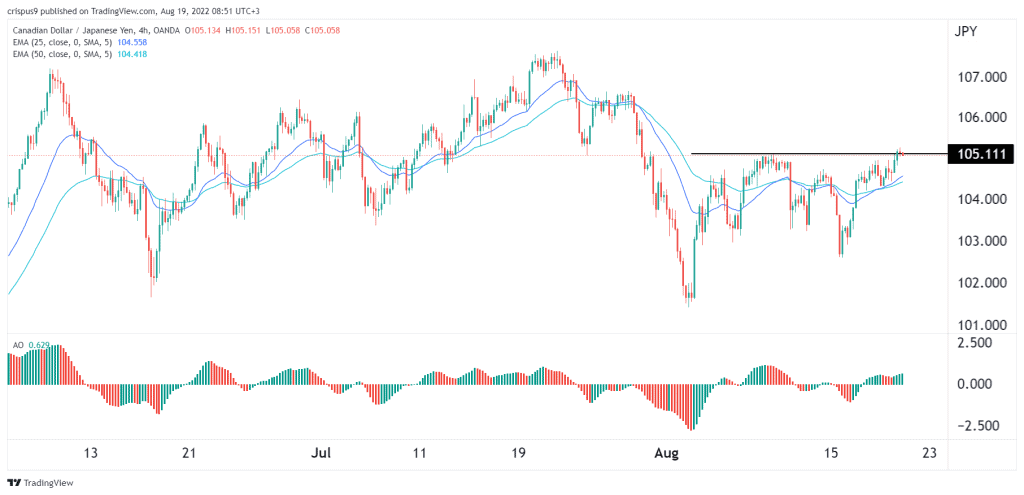

The four-hour chart shows that the CAD to JPY price has been in a strong bullish trend in the past few days. The pair has managed to move from a low of 101.37 to today’s 105.11. A closer look shows that the pair is trading at an important level since it struggled to move above this level on August 9.

The 25-day and 50-day moving averages have made a bullish crossover while the Awesome Oscillator has moved above the neutral level. However, it has also formed a double-top pattern, which is usually a bearish sign. Therefore, the pair will likely resume the bearish trend in the near term. This view will be invalidated if it manages to move above the resistance at 105.30.