The BTC to GBP pair is at its 2nd all-time highest levels, as crypto market stakeholders watch with bated breath to see if the US Securities and Exchange Commission (SEC) will approve the first Bitcoin exchange-traded funds (ETFs).

The SEC has previously denied requests to launch Bitcoin ETFs. But with improvement in regulation and the number 1 crypto getting so much support from lawmakers and previous sceptics-turned-adopters, the SEC could be on its way to giving the green light as earlier as next week. This is according to Bloomberg, citing sources close to the situation.

Several Bitcoin ETFs are undergoing screening, with announcements scheduled for four applications between 18-25 October. The BTC/GBP pair and other Bitcoin pairs have surged this week to anticipate a favourable SEC announcement. The BTC to GBP pair is up 4.3% on the day.

BTC to GBP Price Outlook

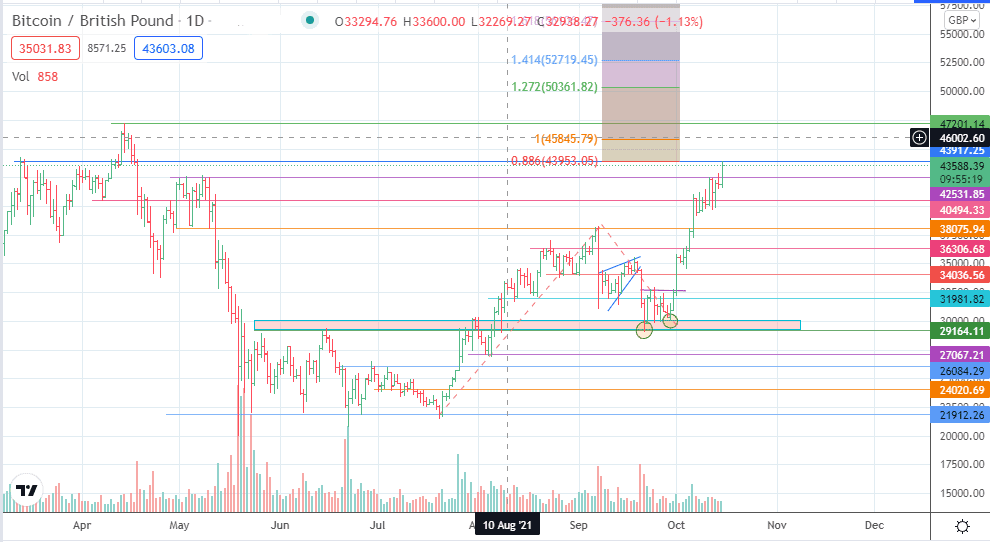

The current price of the BTC to GBP pair is at its 2nd highest level ever. This resistance at 43917 (13 March, 10/18 April highs) is the only barrier to be uncapped before the all-time high at 47240 comes into the picture. The Fibonacci extension levels from the swing low of 21 July to the swing high of 7 September present 50361 (127.2% Fibonacci extension) and 52719 (141.4% Fibonacci extension) the potential targets if the all-time high is taken out.

On the other hand, a rejection of the price action at the current resistance targets 42531 initially, with 40494 and 38075 serving as additional targets to the south. A further correction brings 36303 and 34036 into the picture.

BTC to GBP Pair: Daily Chart

Follow Eno on Twitter.