BT share price made a strong recovery as demand for the stock surged recently. The shares jumped to a high of 196p, which was the highest level since February this year. The stock has risen by over 30% since March, meaning that it has outperformed the FTSE 100 and FTSE 250 indices.

BT Group has been facing several challenges as the cost of doing business rises and its growth slows. Recently, the company’s CEO faced off with its workers who demanded higher pay as inflation surged. In a statement, Philip Jansen, the company’s CEO said that the firm would not afford higher salaries since growth had flattened and the cost of inputs surged.

As a result, the company’s staff voted to go on a strike soon. Workers pointed that the firm’s CEO salary had jumped by 32% in 2021. This increase was mostly because of stock rewards that he received when he was hired.

Meanwhile, the company’s largest shareholder is being watched by UK regulators. They have stopped the clock in a probe into Patrick Drahi’s acquisition of the company’s shares. They have also requested more information about his deal with the company. Drahi owns 18% of the BT Group and has indicated that his stake is passive. There are no signs that he will place a bid for the entire company.

BT share price forecast

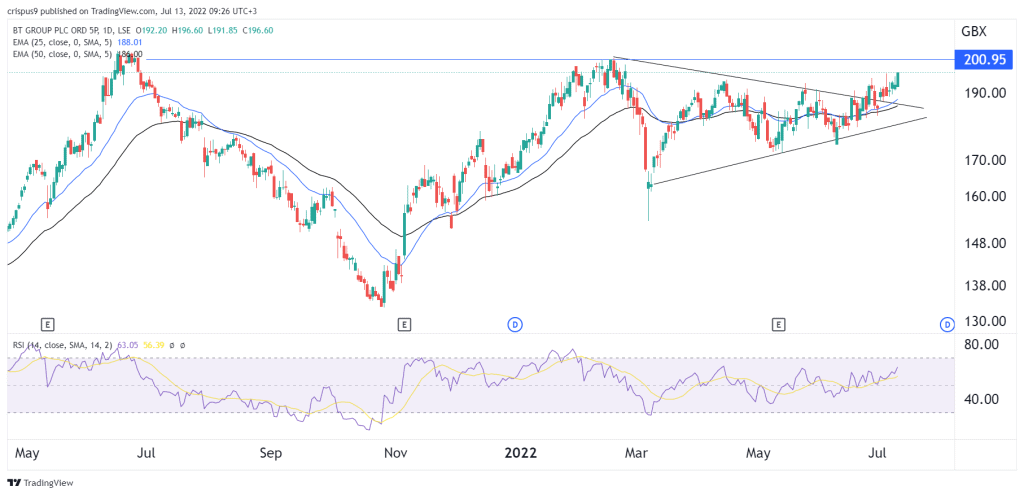

The daily chart shows that the BT stock price has been in a consolidation phase in the past few months. The stock had formed a symmetrical triangle pattern that is shown in black. Now, it has jumped above the upper side of this pattern and is eying the YTD high of 200p.

The BT share price is being supported by the 25-day and 50-day moving averages while the Relative Strength Index (RSI) has moved close to the overbought level. Therefore, there is a likelihood that the stock will continue rising in the near term. The next key resistance level to watch will be at 210p. A move below the support at 190p will invalidate the bullish view.