The BT share price has made a steady recovery in the past few days in line with the overall performance of other UK stocks and the FTSE 100 index. It is trading at 177.95p, which is about 15% above the lowest level this year. It has outperformed its other key competitors like Vodafone and Virgin. As a result, its total market cap has risen to about 17.65 billion pounds.

BT Group is the leading telecommunication group in the United Kingdom, where it offers a wide variety of services. Its most important business right now is OpenReach, which provides important internet solutions to thousands of homes and companies.

LON: BT.A latest news

BT has been in the spotlight in the past few months as investors watch the actions of Patrick Drahi, the French billionaire. He acquired a stake in the firm in 2021 and increased it in December. Another reason the shares have been in the spotlight is that the company is attempting to offload its sporting business in a bid to raise cash and narrow its business focus.

The company’s most recent results showed that its revenue declined by about 2% to 15.67 billion pounds. It attributed this drop to its Global and Enterprise business. But growth in Openreach helped to offset the drop. As a result, its adjusted EBITDA rose by 2% to 5.7 billion pounds while profit before tax dropped by 3%. Analysts believe that the BT share price will likely recover in the next few months because of its UK market share and dividends. Besides, data shows that the company’s insiders have been acquiring the stock.

BT share price forecast

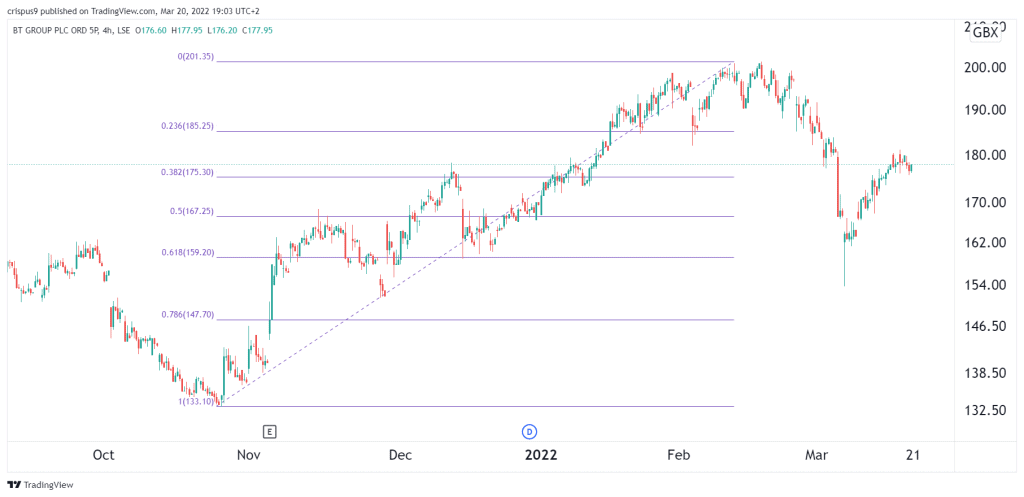

In my last BT Group forecast, I warned that the shares would crash by about 10%. The four-hour chart shows that the BT stock price declined sharply when the crisis in Ukraine started. That was because the company has some exposure to the Russian market. It has rebounded and is slightly above the 38.2% Fibonacci Retracement level.

It has also moved slightly above the 25-day and 50-day moving averages. Therefore, the stock will likely continue the bullish trend in the near term as bulls target the next key resistance at $185. This view will be invalidated if the stock moves below 167p.