The FTSE 100 index is set to open higher today even as the UK economic situation gets worse. Futures tied to the index are up by 0.60% ahead of the services PMI data that will come out in the morning session. Elsewhere, in Germany, the DAX index is set to fall by 0.15% while in the United States, futures tied to the Nasdaq 100 are down by more than 1%.

What’s happening: Attention is in Georgia today where election officials are counting the votes of the byelection that happened yesterday. The final outcome will have an immediate effect to global equities, including the FTSE 100.

For one, if the Democrats take control of the senate, it will lead to more stimulus and higher taxes. On the latter point, many FTSE 100 companies with operations in the US will be affected.

The index is also rising even after the Boris Johnson administration announced a new lockdown to prevent the coronavirus from spreading. This measure will be bad for FTSE components because it will affect demand.

Looking ahead: Looking ahead, the index UK stocks will react to the latest services PMI numbers from the UK that will be released later today. These numbers are likely to show that the important services sector remained under pressure in December. Also, it will react to the US ADP employment numbers.

FTSE 100 companies to watch: Oil companies like Royal Dutch Shell and BP will be the top companies to watch out today. Their shares are likely to continue rising, driven by the surging crude oil prices. Other top firms to watch will be retailers like Tesco, Sainsbury, and Morrison after the weak retail sales numbers released earlier today.

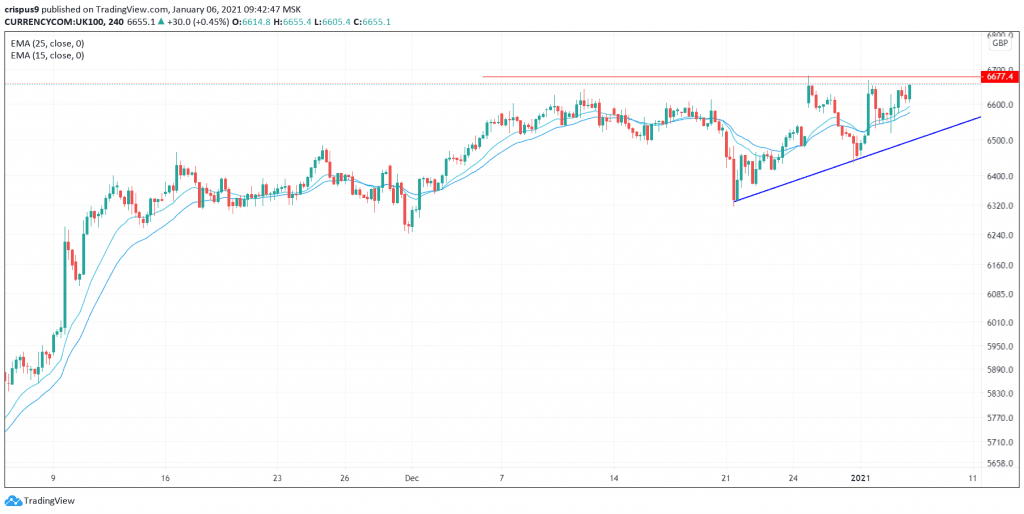

FTSE 100 technical forecast

On the four-hour chart, the FTSE 100 index has formed an ascending triangle pattern whose resistance is at £6,677. The price is also above the 25-day and 50-day moving average while the Relative Strength Index is also rising. Therefore, the index will likely continue rising as bulls target the next resistance level at £6,700. However, a move below £6600 will invalidate this trend.

Don’t miss a beat! Follow us on Telegram and Twitter.

FTSE 100 technical chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Crispus on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.