Wednesday’s 1.60% rise in the price of the international crude oil benchmark has spurred bullish Brent crude oil price predictions. However, this is yet to play out in Thursday’s trading session, where Brent crude trades a tad higher.

Crude oil prices have had a good week, notching three straight days of gains. Wednesday’s move followed Tuesday’s significant 3.67% uptick, as comments by Saudi Arabia’s energy minister stoked expectations of a potential supply cut by the Organization of Petroleum Exporting Countries.

A drawdown in US crude oil inventories also reinforced bullish Brent crude oil price predictions after triggering more demand for the asset. US crude oil stocks fell more than expected for the week under review. Data from the US Energy Information Administration indicated a drop of 3.3m barrels, more than the market consensus, which had forecast a drop of 2.2million barrels in crude oil stocks.

Further adding to bullish pressures is the stalling of the talks between Iran and other world powers for the country to resume its oil exports as part of the 2015 nuclear deal. This further pushes back the prospects of Iran’s oil returning to the world market. Crude oil prices on the Brent benchmark are at three-week highs.

Brent Crude Oil Price Prediction

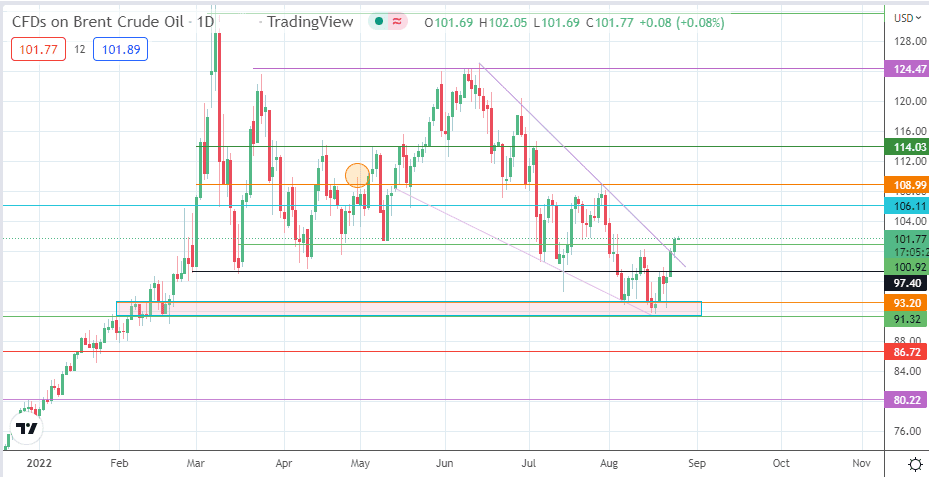

The closing penetration of the 24 August candle above the 100.92 psychological barrier and neckline completes the double bottom pattern. This scenario means that the pathway toward attaining the measured move’s completion point at 108.99 (13 April/28 July highs) is now clear.

However, an obstacle remains at 106.11 (9 March/19 May lows), and the bulls must uncap this for 108.99 to become available. If the advance continues, the 114.03 resistance (5 May and 4 July highs) becomes the next available upside target.

On the other hand, a decline below the 100.92 support invalidates this outlook and presents 97.40 (28 February, 16 March and 12 August lows) as the initial downside target. A further decline brings the ceiling of the previous demand zone at 93.20 into the mix as the next target to the south. Only a complete breach of this zone brings the 86.72 support into the picture as a previous low found on 25 January 2022.

Brent Crude: Daily Chart