The BP share price has been in a strong bullish trend in the past few months. The stock jumped to a high of 392p, which was the highest level since February 2022. Other oil and gas stocks like Shell, ExxonMobil, and Tullow Oil have done well.

BP news

The main catalyst for the BP share price is the overall performance of oil prices. Brent has surged to $90 and analysts believe that it is just a matter of time before the stock hits $100.

Therefore, analysts expect that BP will report strong quarterly earnings on February. Most importantly, the firm is expected to have a solid guidance when it delivers its results.

BP has also risen because of the Omicron variant. Most countries have ended their restrictions and many airlines have restarted their schedules. Therefore, there is a likelihood that BP will hint about more dividends.

Analysts are optimistic about the BP share price. For example, they expect that the American-listed shares will rise from $28 to $37. Similarly, according to Marketbeat, analysts expect that the stock will rise to 456p from the current 392p.

BP share price forecast

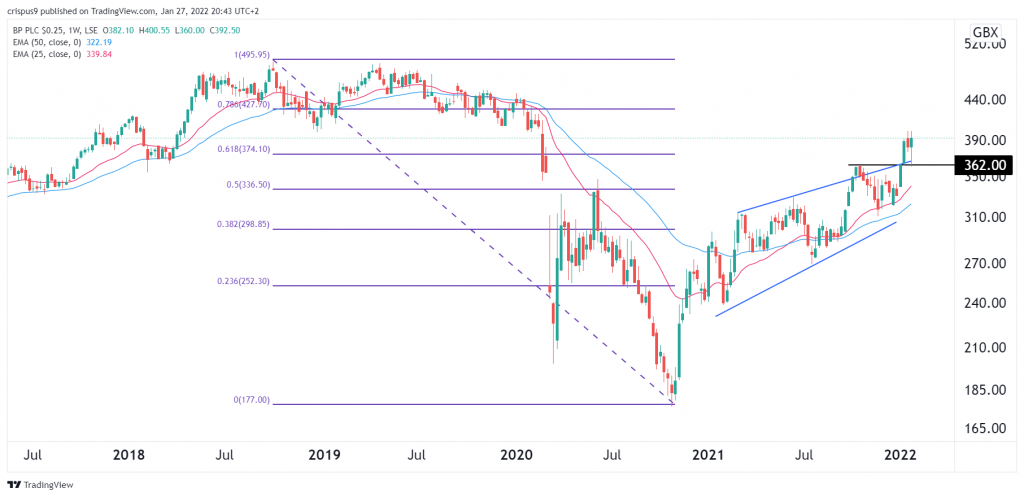

The weekly chart shows that the BP stock price has been in a strong bullish trend in the past few months. The stock has managed to rise above the 25 and 50-week moving averages. It has also risen above the 61.8% Fibonacci retracement level. Oscillators like the Relative Strength Index (RSI) and MACD have also risen.

Therefore, the stock will likely keep rising as bulls target the next key resistance at 450p. This view will be invalidated if the price drops below 362p.