The BP share price looks set to retest the 2022 highs it posted on 30 August following a solid performance on Monday in London trading. The BP share price is 2.72% higher on the day, buoyed by a 3.5% rise in Brent crude oil price.

The uptick follows Friday’s 2.83% gains and also comes as the Organization of Petroleum Exporting Countries and its partners (OPEC +) agreed to cut daily production by 100,000 barrels per day. The decision by the alliance was unanimously agreed on and will come into effect in October. The move also overrides last month’s vote, which had agreed on an increase.

The move follows the failure of several OPEC + members to meet their production targets. The statement says the 100k bpd cutback applies to September 2022 only, opening the door for a further review when the 33rd OPEC and non-OPEC Ministerial Meeting holds on 5 October 2022.

Oil stocks are also seeing a boost in price after Gazprom, Russia’s state-owned energy company, shut down the Nord Stream 1 pipeline indefinitely. Russia says it will not open the pipeline until all Western sanctions against it are lifted.

The news has expectedly boosted demand for oil stocks, with the BP share price now on course to plot new highs for the year if the recently acquired 2022 high at 469.60 is breached.

BP Share Price Forecast

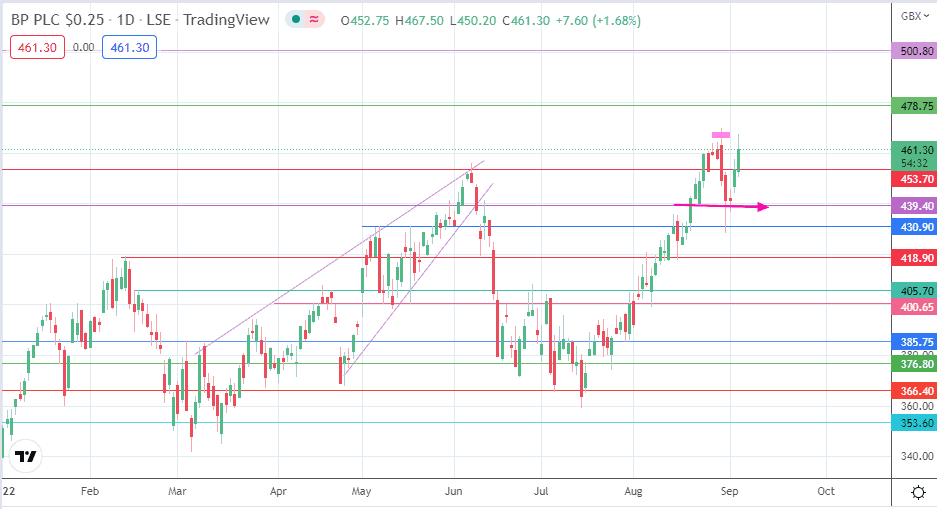

The bulls need to achieve a closing penetration above the 30 August high to resume the uptrend, targeting the 478.75 resistance initially (11 February 2020 high). If the bulls successfully uncap this level, the pathway becomes clear for the bulls to push toward 500.80, another psychological barrier and site of the 17 January 2020 high.

This outlook is negated if the bulls fail to achieve a closing penetration above 469.60. This scenario leads to a potential double top, which will then require a corrective decline below the 439.40 support (14 June high and 22 August low) to complete the pattern. A decline below this neckline allows the bears to aim for 430.90 (1 June and 31 August lows), before targeting completion of the double top at 418.90 (24 May and 15 August lows).

BP: Daily Chart