The last week has seen an unprecedented drop in Bitcoin prices to lows not seen in the last 10 months.

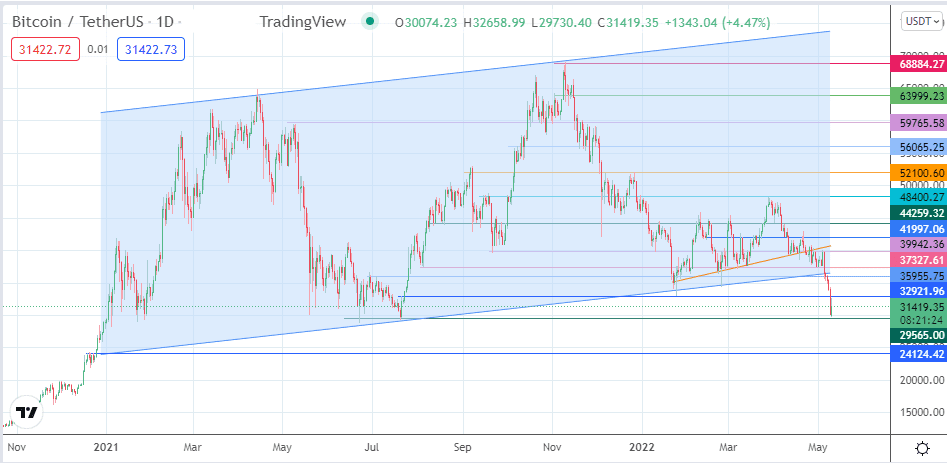

Bitcoin prices had been trading within the confines of the large ascending channel. The breakdown of the channel’s trendline at the 35955 price mark was triggered the selloff witnessed on the charts and spurred pessimistic Bitcoin price predictions. The fundamental trigger to this price move appears to be the 50bps rate hike by the US Federal Reserve on 4 May 2022, in response to 40-year inflation highs.

An increase in interest rates makes the bond market and other money-market instruments more attractive than the risky crypto markets. Bonds attract a steady and assured return on investments and are the preferred vehicle of investment for pension funds and other risk-averse funds. Hedge funds that are less risk-sensitive also use these investment vehicles if the conventional markets they trade in become too volatile or if their returns trail that of markets such as the S&P 500 index.

Note that when stock and commodity markets were falling at the height of the pandemic in 2020, investment flows into the crypto market increased significantly, led by purchases of hedge funds such as MicroStrategy. At this time, Bitcoin prices shot above their previous 2017 highs of $19,500 and traded as high as 64,000 in April 2021.

Data from Glassnode indicates that the total number of Bitcoin held on crypto exchange addresses increased by more than 2.7% last week. The amount of BTC that poured into exchange platforms also topped 67,700. These data clearly showed that the selloff seen in recent days was underway.

Bitcoin is typically held in wallets when investors are HODLing. If the investor wants to sell, these coins have to be moved from cold wallets to the exchanges. An increased flow into exchanges is regarded as a bearish indicator. Even though the correction appears to have stalled, the rejection seen in the daily candle at the immediate resistance is a cause for worry.

Look at the daily chart. See the orange-coloured ascending trendline that connects the key lows of January to March 2022? The breakdown of this trendline on the 22/23 April candles shifted sentiment towards the bearish end of the spectrum. Three rejections of attempts to break back to the upside triggered this week’s fall.

The present dip returns prices towards the January and July 2021 lows. The big question now is: will bullish Bitcoin price predictions hit the market now that these lows have been acquired?

What is Supporting Bitcoin’s Price?

The bounce seen in Bitcoin prices was prompted by the 500BTC purchase made by El Salvador’s government at an average price of $30,744. TRON Founder Justin Sun also tweeted that the TRON Decentralized Autonomous Organization (DAO) had purchased a similar quantity of BTC at an average price of $31,031. Hedge fund MicroStrategy indicated in a report today that BTC prices needed to fall to $21,000 before one of its loans faced a margin call, forcing the fund to put up more collateral for its loans. The loans in question were a $205m term loan secured from Silvergate Bank to purchase its Bitcoin stash. MicroStrategy has already indicated it has no intention of ever selling its BTC stash.

The present picture, fundamentally speaking, seems to indicate that several major players are through their acquisitions, confidently making Bitcoin price predictions of a floor at 29,000/30,000.

Bitcoin Price Prediction

The expected bounce in Bitcoin prices has occurred after the price touched off the lows seen on 22 June and 20 July 2021, just above the 29,730 price mark. The recovery move has stalled at the resistance formed by the previous high of 21 July 2021 and the prior low of 24 January 2022. The bulls must uncap this resistance to allow for an additional recovery towards the 35955 price mark (4 July 2021 high and 27 January low). Other resistance barriers are seen above this level at 37327 (4 February and 7 March low) and at 39942 (24 February and 4 May highs). A break of the 40,000 psychological price mark is required for the 42,000 and 44260 barriers to enter the mix as additional northbound targets.

Conversely, a failure to breach the barrier at 32921 allows for sellers to re-enter the market, targeting a breakdown of the 29565 support level. If this support breaks down, descent towards the 20 December 2020 highs of 24008 becomes a valid possibility. This low was called by one of the US investment banks in early 2021.

BTC/USDT: Daily Chart

Follow Eno on Twitter.