The Bitcoin Price dropped $1,800 from $61,800 to $60,000 in Asian hours before bouncing from the psychological support level. Despite pulling back around -10% from the all-time high, Bitcoin (BTC) closed out October with a $40% gain to record its best month in 2021. This morning, BTC is slightly softer at $60,474 (-1.42%), reducing its market cap to 1.14 Trillion and its crypto market dominance to 44%.

Over the last two weeks, the rally from the start of October has morphed into violent two-way price action between $58,000 and $63,000. The Bitcoin price has plunged below $60,000 several times over the last week before rebounding to the top end of the range. The price action seems designed to cause confusion and frustrate the bulls and the bears. However, the backdrop shows classic signs of a cycle top, as we outlined in our premium Bitcoin report last week. Firstly, each parabolic surge to a new high this year has been followed by a sharp correction. Secondly, euphoric rallies in meme-coins, like we have seen recently with Shiba Inu (SHIB), have been a good indicator of previous high. Furthermore, I believe the market is vastly over-estimating the relevance of the ProShares Bitcoin ETF (NYSEARCA: BITO).

Pitfalls of the BITO ETF

Whilst, the futures-based Exchange-Traded Fund is a step in the right direction, it’s an awful way to gain exposure to BTC. Because the forward curve of Bitcoin is in contango, holders experience a negative roll effect, meaning the cost of holding a position increases over time. Furthermore, the fund’s limited trading hours leaves investors exposed overnight and at the weekend. If the Bitcoin price drops during these periods, the ETF will likely gap lower when trading commences. On that basis, the ETF will probably have limited appeal to an institutional investor. Considering the listing was the main driver from $43k to $67k, I expect BTC to retrace a large part of the 50% gain.

BTC Price Analysis

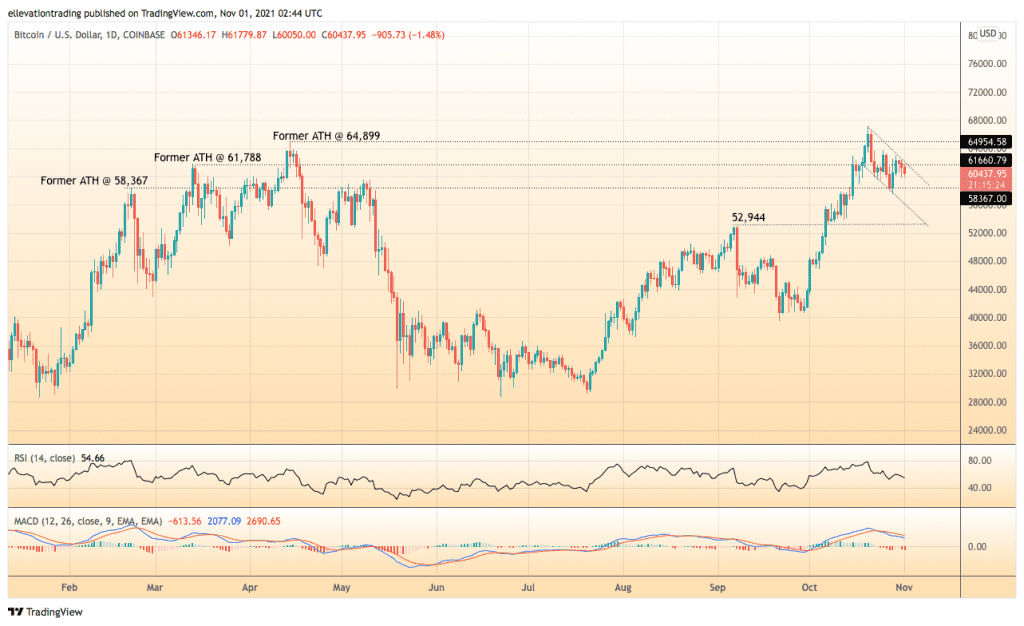

The daily chart shows that BTC is trending lower in a parallel channel. This morning, the Bitcoin price tagged the top edge of the channel perfectly before sliding lower. As a result, the price looks on track to test last weeks low of $57,650. And if Bitcoin closes around that level, it will be the third all-time high of 2021 to be lost on a closing basis. In my opinion, a close below $58,367 (February high) lines up an extension lower towards the September high of $52,944.

Suppose BTC ends the day below $61,788 (March ATH and top of the descending channel) it will reinforce my bearish conviction and $53k price target. Therefore, a close above $61,788 derails the bearish view, for now anyway.

Bitcoin Price Chart (2-Hour)

For more market insights, follow Elliott on Twitter.