The Binance Coin price has formed extremely bearish patterns, signalling the sell-off. The BNB token is trading at $293, which is the lowest it has been since May 19th. It has fallen by almost 70% from its all-time high, bringing its total market cap to about $50 billion. This makes it the fourth-biggest coin after Bitcoin, Ethereum, and Tether.

There are several reasons why the BNB price has been in a strong sell-off lately. First, demand for cryptocurrencies has been in a strong downward trend because of their performance. The significantly weak results evidenced this by Coinbase, which made a $400 million loss in the first quarter. The firm’s number of active monthly users of its platform also declined. This is notable since the BNB token is widely used in Binance’s ecosystem.

Second, the key sectors of the blockchain industry like non-fungible tokens (NFT), decentralized finance (DeFi), and gaming have all declined. For example, the volume of all NFTs traded in April was down by more than 50% from the previous month.

Similarly, the total value locked in DeFi has crashed to less than $110 billion. At its peak, the industry had over $250 billion. Third, the total number of transactions in BNB has been in a sharp downward trend. This signals that demand for the coin has declined.

Binance Coin price prediction

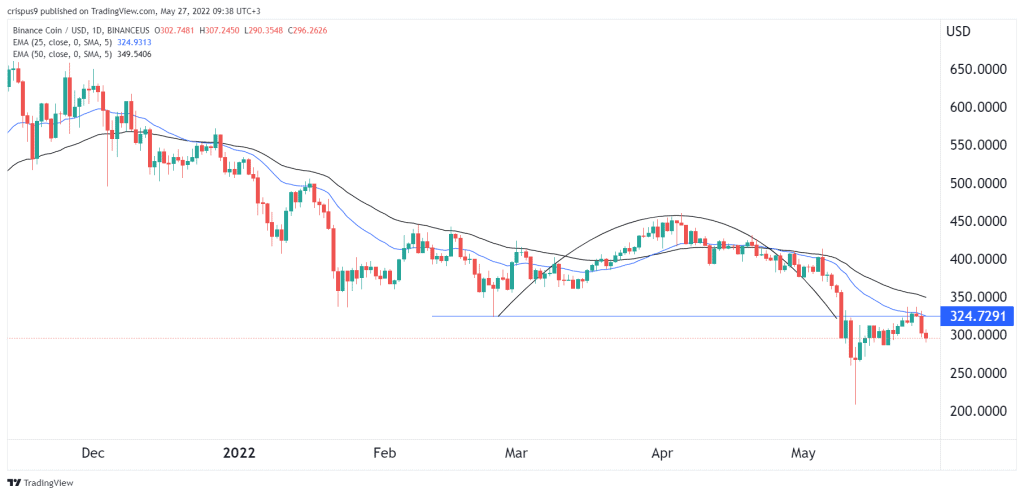

Turning to the daily chart, we see that two extremely bearish patterns have formed: an inverted cup and handle and a bearish flag. The two patterns signal that the sell-off will likely continue. At the same time, the coin has moved below the 25-day and 50-day moving averages. It has also retested the lower side of the inverted cup pattern.

Therefore, the Binance Coin price outlook is extremely bearish, with the next key level to watch being at $250. A move above the key resistance level at $340 will invalidate the bearish view.