The Beyond Meat share price tumbled on Wednesday after an earnings call that painted grim financial results for the first quarter of 2022. The plant-based meat company sustained a net loss of $1.58 per share, which was worse than analysts’ expectations.

A poll of Wall Street analysts had predicted a loss of $0.97 per share. The company also missed estimates on revenue. However, revenue increased 1.2% on an annualised basis, rising from $108.2million to $109.5million. Analysts had predicted a revenue intake of $111.6million.

The earnings results did not amuse investors, and this led to an after-hours selloff that cut 13.83% from the Beyond Meat share price. A drop in sales within the US market and increased competition in the plant-based meat industry is blamed for the poor performance. Competition is now coming from Tyson Foods Inc and Kellogg, who are offering discounted products to woo customers.

The plunge extends the losing streak on the stock to five consecutive sessions. If investors decide to dump more of the stock, a sixth straight day of losses could be in the offing when the Nasdaq 100 index opens for trading later in the day.

Beyond Meat Share Price Outlook

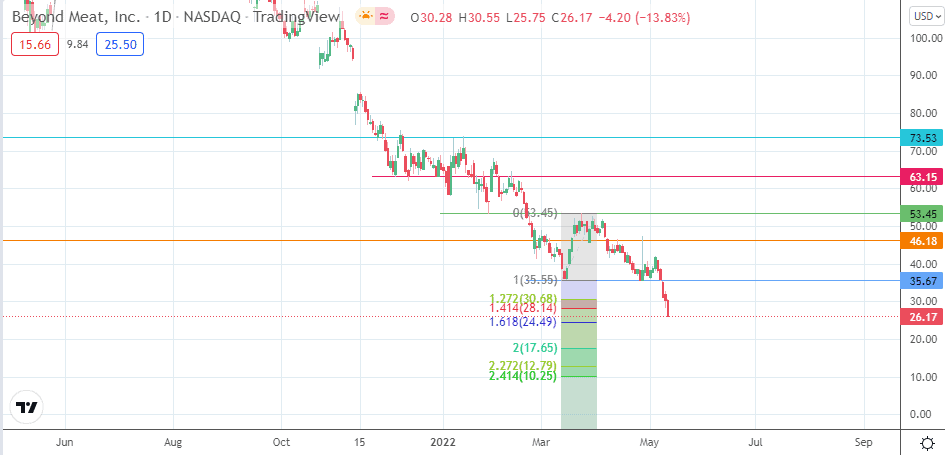

The stock is now trading at all-time lows after breaking below the 35.67 support (15 March and 27 April lows). The breakdown move has also taken out potential pivots at the 100% and 127.2% Fibonacci extension levels and appears headed for a test of the 24.49 price mark (161.8% Fibonacci extension level).

If the bulls fail to provide support at this price, a further decline towards the 200% Fibonacci extension mark at 17.65 could be on the cards. On the flip side, recovery requires a bounce at the approaching Fibonacci extension mark. If the 24.49 price mark holds up to bearish scrutiny,

a bounce could send the price on a test of 28.14 (141.4% Fibonacci extension). Above this level, 30.68 (127.2% Fibonacci extension level) and 35.67 form additional barriers to the north. If the recovery move uncaps these levels, 46.18 (4 March and 27 April highs) and 53.45 (23 March high) become additional northbound targets.

Beyond Meat: Daily Chart

Follow Eno on Twitter.