The Bed Bath and Beyond share price experienced a turnaround of fortunes in Thursday’s trading session, as the new interim CEO Sue Gove purchased 50,000 additional shares of the company. The price uptick exceeded 30% before the bears came in to force a pullback.

The share purchase by the interim CEO was done on 1 July at a company-weighted price of $4.61 but was made public via an SEC filing on 6 July. The purchase also sends Gove’s Bed Bath and Beyond share price holdings to 105,87 shares.

This purchase followed some stock purchases by company insiders. Company chair Harriet Edelman bought 10,000 shares of the company at $4.94, according to a 6 July SEC filing. The Chair’s purchase was also added to by Board Member Jeff Kirwan’s 1 July $49,000 stock purchase, done at a Beyond Meat share price of 6 July.

The company is just coming off an executive shakeup which saw the exit of erstwhile CEO Mark Tritton, who spent just over a year 30 months in office. Tritton had come in with a brief to turn around the company’s fortunes after it went a total of ten quarters of falling sales. The recent earnings report was the final straw that sent Tritton packing.

Despite the stock trading 2.57% lower in Friday’s premarket trade, the current sentiment seems to favour a short-term rally on the stock following the reversal from the low of 5 July 2022.

Bed Bath and Beyond Share Price Forecast

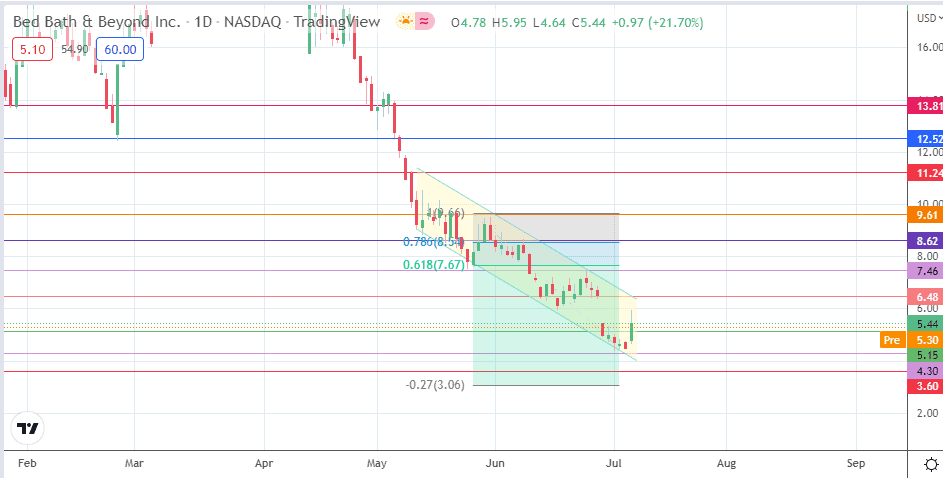

Thursday’s intraday uptick came off Tuesday’s bounce on the 4.30 price mark. This uptick has violated the resistance at the 5.15 price level. 6.48 is an additional target to the north, which enters the mix before the bulls can aim for the 7.46 (24 June high) and 8.62 (8 June high) price marks.

On the flip side, the 6.48 or 7.46 price marks is the immediate resistance which could provide a fulcrum for the bears to initiate a continuation of the downtrend. This move will target the 5.15 resistance-turned-support initially. If the bulls fail to defend this support, the 4.30 price mark (5 July low) becomes the new target. The downtrend is re-established if the bears break down this support, leaving 3.60 and 3.06 (0.27 Fibonacci extension mark) as the additional southbound targets.

BBBY: Daily Chart