The BAE Systems share price may be down today, but it is on the ascendancy and is close to launching into record territory as the war in Ukraine sparks a defence spending frenzy by the UK and European nations. Apart from the recent contract awarded to the firm by the UK to build next-generation nuclear submarines, BAE Systems is also making inroads into other defence markets.

On 20 May, the company announced that it had delivered the first four CV90 Combat Support Vehicles to the Norwegian Armed Forces. These are the first of twenty that will be delivered in partnership with Ritek AS and Norway’s Defence Material Agency.

Earlier in the month, the company had showcased its unmanned Robotic Technology Demonstrator (RTD), which was built on the M113 armoured car’s lower hull. This is as it seeks to develop a US Army-type Robotic Combat Vehicle Medium (RCV-M).

As long as geopolitical tensions exist, there is the potential for good business for the company, which should boost the BAE Systems’ share price in the medium term. The average 12-month target for the BAE Systems share price set by institutional analysts is 867.60. This gives the stock a 12.1% upside potential, which is also in keeping with the price target expected of the bullish resolution of the ascending triangle on the daily chart.

BAE Systems Share Price Forecast

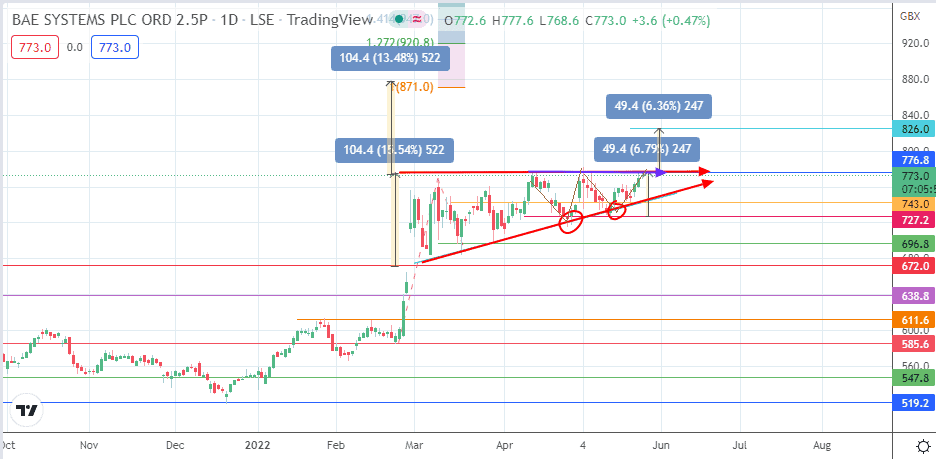

The active daily candle is now testing the resistance at the 776.8 price mark (13 April/6 May highs). This resistance marks the upper boundary of the ascending triangle. A break of this area will target a measured move that potentially ends at the 871.0 price mark (100% Fibonacci extension of the price swing from the 22 February low to the 9 March high and back to the 17 March low). You may also visualize the double bottom within the pattern, which presents a measured move termination point at 826.0. These are the potential targets to look for.

On the flip side, a decline below the triangle’s lower border invalidates the pattern and opens the door for a drop towards 696.8 (16 March/29 March lows). Below this level, additional support is seen at 672.0 (20 February 2020 high) and 638.8 (24 February high). Other downside targets that become viable on further price deterioration are 611.6 and 585.6 (22 February low).

BAE Systems PLC: Daily Chart