The BAE Systems share price is up this Monday, opening with an upside gap as the bulls dominate the price action. This follows the violation of the 776.8 resistance on Friday after the stock gained 2.94%. Today’s gap has sent the stock higher by 1.67% as of writing, even as the stock lost some of its opening gains.

The continued demand for the stock follows the tailwinds that new defence contracts are providing to the BAE Systems’ share price. Recall that in early May, the UK government awarded the company a $2.5billion nuclear submarine contract. Since then, BAE Systems has notched several deals in different countries. Moreover, with the Russia-Ukraine conflict now in its fourth month and showing no signs of ending, European countries are upping their defence spending, which signals an opportunity for the firm.

The latest support for the BAE Systems share price could come from the $334 million technical support and upgrade contract that will see BAE Systems work with Babcock International and Lockheed Martin to upgrade the Royal Navy’s stockpile of Tomahawk land-attack missiles. The contract was made public last week and is driving renewed interest in the stock.

BAE Systems Share Price Outlook

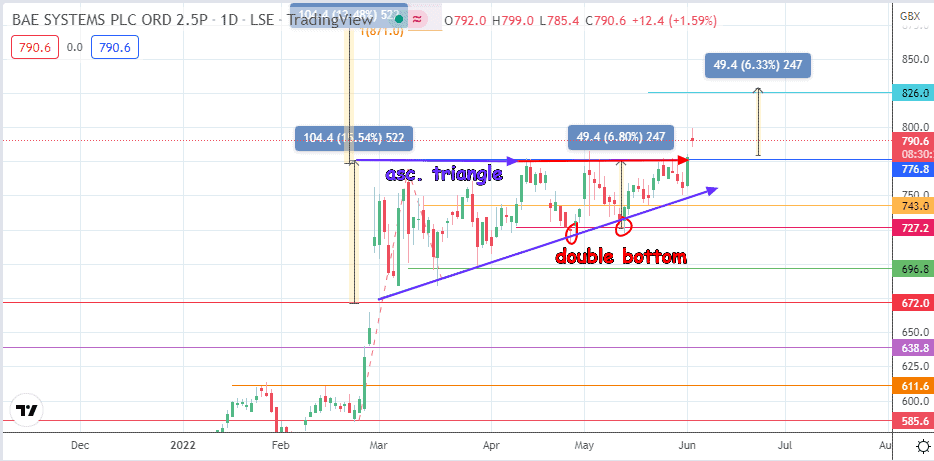

The bullish break of the 776.8 resistance has occurred as expected. If you take the double bottom as the pattern for reference, the measured move is expected to touch off the 826.0 price mark. So far, the price action has met resistance at the 800.0 psychological price mark. This barrier needs to give way for 826.0 to become a reality.

If the ascending triangle is the bullish reference pattern, then the measured move is expected to complete at 871.0. Therefore, 826.0 must also give way for this price point to become a reality.

On the flip side, a decline from the present levels will retest the 776.8 resistance-turned-support level. If the bulls fail to force a bounce to resume the breakout move, a potential drop below 776.8 could be in the works. 743.0 (3 May/20 May lows) becomes the new downside target if this breakdown occurs. Below this level, 727.2 and 698.8 (16 March and 30 March lows) form additional barriers to the south.

BAE Systems: Daily Chart